“International dairy markets, like domestic ones, like all commodity markets, move in cycles,” notes Tom Suber, president of the U.S. Dairy Export Council (USDEC). “While significant factors are forcing us out of 15 to 20 months of historically high prices into a weaker phase, we are not likely to return to the depths of historical cycles.”

From 2003-07, milk production in the European Union-27, New Zealand and Australia, which together account for more than 60 percent of global dairy trade, declined by more than 1%. This cut into exportable supply; dairy exports (milk equivalent) from the two regions dropped 5.3% in the four-year span. On a volume basis, both annual production and exports were 2.1 million tons lower in 2007 than they were in 2003.

Global dairy demand accelerated at the same time, particularly in Asia and oil-rich economies. In Indonesia, imports of milk protein via milk powder and whey increased 70% from 2002-06. Singapore imports increased 61%; Saudi Arabia and Vietnam, more than 50%; and China, 31%. In just these five markets, milk protein imports increased by more than 77,000 tons, a volume that required 2.4 million tons of milk.

Record-high prices

With robust demand drawing on a depleted supply base, global dairy prices rallied to record highs in 2007. U.S. dairy exporters thrived in this climate. From 2003-07, milk production increased 2.2% annually in the United States – the only net-exporting country in the world to post significant production growth. Much of this incremental growth went to satisfy overseas demand.On a total-solids volume basis, U.S. dairy exports increased 83% in four years from 2003 to 2007. More significantly, U.S. market share of global dairy trade increased from 7.5% in 2003 to 13.1% in 2007, according to USDEC. By value, U.S. exports increased 30% annually from 2003-07, topping $3.0 billion last year. Skim milk powder/nonfat dry milk, whey proteins, lactose and cheese were the biggest success stories.

High prices the last two years have fueled a recovery in production, bursting the dairy bubble. “Record milk prices have encouraged additional milk supply, even though farmers have been facing higher input costs,” says Deborah Perkins, managing director for Rabobank International, New York.

Oceania milk production is off to a strong start in the 2008-09 season after several years of drought. EU-27 milk production in the first seven months of the year was up 1.3%, putting it on track to finish at its highest level since 2005. U.S. milk production is up more than 2% this year for the fourth straight year. Production from these three regions is projected to increase about 2% this year, making available an additional 4.9 million tons of milk.

Though it took a while for the high prices of 2007-08 to work through to consumers, they are now also deterring demand. It took six to nine months for the run-up in wholesale dairy commodity prices to be passed through, and now retail dairy prices are up by double-digit percentages throughout the world. Higher costs for grains and fuel have cut into consumer purchasing power as well. With less money to spend, consumers are buying less dairy and less food that includes dairy components – in developed countries as well as developing ones.

Just as significantly, multinational buyers of dairy ingredients perceive there is inventory available, so they don’t have to order as aggressively as they did in 2006-07. “Oceania and Europe are in an undersold position for the first time in two years,” says Saul Rosenberg, president and chief executive officer of Gerber California, a global food trading company based in San Diego. “A perception of strong forthcoming production for Oceania and the Southern Cone has most buyers wary of making commitments beyond immediate needs.”

Adds Perkins: “It’s important to remember that dairy is thinly traded. Small ripples in national markets can create large waves in the traded market.”

Weaker markets for a while

From mid-July to mid-October, world dairy commodity prices dropped roughly 20 to 30% as the global supply-demand balanced shifted. Meanwhile, the U.S. dairy industry, now so reliant on overseas markets to absorb its growing milk supply, has seen its markets turn weaker as well.Nowhere is this more evident than on milk powder. Just prior to Labor Day, nonfat dry milk (NDM) in the Western region was still trading for $1.35 to $1.39, according to the U.S. Department of Agriculture’s Dairy Market News. Six weeks later, the price had plunged to close to a dollar. Even more startling, in the first week of October, manufacturers shipped more than 8 million pounds of NDM to the government under the price support program, the first sales to the Commodity Credit Corp. in more than two years.

The U.S. and global whey markets are reeling from last year’s demand-killing price escalation as well. In late September, U.S. whey prices fell below 20 cents for the first time in 4½ years.

Long-term, income and population growth will continue to be the key drivers of increased dairy consumption, Perkins says. Ultimately, the rising costs of local milk production and falling global prices will direct many buyers back to imports. But she believes short-term demand will remain under pressure, due to effects of the global economic crisis, rising retail prices and the lure of product substitution.

And then there's China ...

The world dairy markets were already unsettled when a tainted dairy crisis in China broke in early September.The discovery of melamine in Chinese dairy products led more than two dozen countries to impose all-out bans on Chinese dairy products, while other nations issued recalls of suspect products of Chinese origin. At home, Chinese consumer confidence in dairy products, especially those from domestic sources, collapsed.

This crisis is no small event. China is one of the world’s largest buyers of dairy ingredients, importing almost 300,000 tons of whey proteins, milk powders and lactose last year. About one-third of the whey and SMP they use, and about half of the lactose, goes into infant formula, the product at the center of the crisis.

The recovery process is unfolding daily. In the immediate aftermath, the Chinese dairy industry was decimated. Sanlu, the first company identified in the scandal (43% owned by Fonterra of New Zealand), is near bankruptcy and has ceased production. Mengniu and Yili, the two largest dairy companies in China, have seen sales drop dramatically. Domestically made products have been pulled from store shelves, so plants have had to turn away milk. Farmers are dumping milk or selling cows.

Alternatives to domestic Chinese milk powder are reportedly in demand: Nestle, Wyeth, Abbott, Murray Goulburn and Nutricare are among those who reported increased sales in the weeks following the outbreak. New sales leads have emerged for U.S. product, says Daniel Chan, USDEC’s China office representative since 1994. Sales of soy beverages also jumped initially. However, these alternatives are not an option for all; imported infant formula can cost more than three times as much as domestic brands. Between the higher cost and consumers’ fear of dairy products, overall demand is down and is expected to continue trending lower in the months ahead, Chan says.

Analysts expect it will take 1 to 2 years for confidence in the Chinese dairy sector to be restored, which will eventually lead to resumption in dairy purchases. Government officials, pledging to clean up the dairy industry, have implemented new product safety regulations and provided subsidies to processors and farmers to keep them afloat. Chan expects long-term demand for dairy ingredients and cheeses to continue to rise due to higher incomes and a steady increase in living standards.

Long-term proposition

Through August, U.S. dairy exports were nearly $2.8 billion, up 60% from 2007’s record level. At that pace, exports are on track to clear $4 billion in 2008, even with a slowdown in the fourth quarter.Experienced, committed exporters are accustomed to riding the ups and downs of the market. The key is for suppliers to continue to differentiate their products, on everything from value-added offerings like cheese and higher-protein whey to commodity products like milk powder.

“Exports are a long-term proposition,” says USDEC’s Suber. “And we agree with other forecasters that the lasting, structural fundamentals are still positive. Markets may be softer in 2009, but we still believe global demand will, over the medium term, trend higher.”

Lower stocks mean the global dairy markets will continue to cycle around equilibrium, he adds. “Market returns will quickly affect supply growth, while demand will remain driven by net purchasing power. In this phase in the evolution of U.S. dairy exports, shocks – price, weather, policy, scares – will continue to drive market volatility,” Suber says.

World milk consumption on the rise

Contributed by Zenith InternationalGlobal consumption of milk drinks has risen by 13% from 214 billion liters in 2002 to 242 billion liters in 2007, according to a new report from leading food and drink consultancy Zenith International.

“Asia has seen the most consistent growth, mainly due to booming demand in China,” said Esther Renfrew, Zenith dairy market intelligence manager. “Consumption in Asia/Australasia has increased from 18.3 liters per person in 2002 to 22.9 liters in 2007.”

Milk sales have also advanced, but at a slower rate, in more developed markets. Flavored milk accounted for 4.7% of global milk drink volume in 2007; growing fastest is the Middle East, where it has a share of 8.5%. In the past five years, flavored milk volumes have grown by 2% in West Europe and by more than 10% in Latin America.

In order to meet growing competition from other drinks, particularly in developed countries, producers have increasingly focused on adding functionality; in one year, more than 2,300 new functional dairy drinks were launched. Although functional milk drinks are still a niche segment, volumes are growing fast.

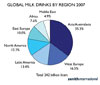

Zenith’s 2008 Global Milk Drinks report also finds that Asia/Australasia was responsible for 35% of global milk drinks consumption in 2007, followed by West Europe on 16.5% and Latin America with 13%. India topped the national leader board at 37,000 million liters in 2007, and the United States was the leading market for flavored milk at 1,600 million liters.

Global milk drinks volumes are forecast to rise by 19% in the five years to 2012.

Global Trends in Functional Dairy

Contributed by Krista Faron, MintelDairy has always been associated with goodness, nutrition and great taste. But as consumer needs evolve and products are asked to deliver an extra dose of value, the dairy industry has moved into the world of functional foods. Global dairy processors continue to set the benchmark higher for existing functional categories and pave the way for emerging ones.

According to Mintel’s Global New Products Database (GNPD), 55% of all digestive health products launched from January to August 2008 came from the dairy category. The meteoric rise in probiotics has transformed immunity into a mainstream health benefit that was introduced in more than 160 global dairy products in 2007. And dairy’s naturally high calcium content has made it a natural fit for hundreds of dairy-based bone health products.

But dairy is also reinventing itself in new functional areas. Beauty foods are one of the most exciting segments of the functional world, and dairy has played an integral role in their global development. These products apply an “inside-out” philosophy to beauty that assumes consumers can improve their physical appearance by eating the right foods instead of applying them topically.

In Europe and Asia where beauty foods are best established, dairy has become an ideal vehicle for delivering beauty-enhancing ingredients. Collagen is already a popular ingredient in Asian drinkable and spoonable beauty yogurts, while tea in various forms is emerging as a beauty ingredient that creates radiant skin. For instance, in Vietnam, Vinamilk recently launched a Green Tea Flavored Drinking Yogurt, and Lala introduced Silhouette Plus Drinking Yogurt with Red Tea Extract in Mexico.

Antioxidant vitamins are also the source of beauty benefits in many dairy products. Dannon Essensis – a line of European beauty yogurt that is arguably the highest profile dairy-based beauty launch to date – makes use of antioxidant vitamin E, as well as green tea extracts.

Cardiovascular health is one of the most established functional areas. To its credit, the dairy industry has been very progressive in adding functional ingredients that contribute to heart health.

Cholesterol-lowering plant sterols have been available in yogurt for several years, but they are now finding their way into other dairy categories including milk. Kroger is one company leading that trend with the introduction of its Active Lifestyle Cholesterol Lowering Fat Free Milk. Omega-3s are also being used as heart health ingredients in dairy products. Nestlé’s Nesvita Pro-Health Milk, available throughout Asia, and Kemps Plus Healthy Lifestyle Low Fat Milk sold in the United States both rely on omega-3 fatty acids for their cardiovascular benefits.

An emerging category of functional foods focuses on a new area of cardiovascular health-blood pressure control. An appropriately named product, 120-80, is a drinkable yogurt designed for South Korean consumers who want to balance their blood pressure. Works With Water from the United Kingdom uses dairy peptides in its Natural Pomegranate Water to target those who want to follow a blood pressure-controlling diet. Thus far, blood pressure control products are relatively few in number, but dairy appears to hold promise in this emerging area.

Functional dairy products targeting the mind still represent a fraction of functional dairy launches, but they are growing quickly. Omega-3s, which are also used for cardiovascular health, are the core of many dairy-based mental function products. Their cross-generational appeal likely accounts for their growing popularity. Omega fatty acids, especially DHA, are integral to brain development in children, but they are also important in maintaining cognitive function as consumers age.

In Spain Danone’s Danonino Petit Genio (“Little Genius”) drinkable yogurt competes with Kaiku’s emmi Actif Memory Drinking Yogurt. Both contain DHA and are targeted to the littlest consumers. Young lovers of string cheese can now find an extra boost of omega-3s in products including Parmalat’s Smart Growth Cheddariffic Stringable Cheese (sold in Canada and made with DHA) and Sorrento’s Precious +Plus String Cheese (available in the U.S. and made with both DHA and EPA-another omega fatty acid). Energy drinks enthusiasts in China may be attracted to Mengniu Dairy’s Future Star Wisdom Milk with taurine or Danone’s Dan Up Ice & Creamy Milk Drink with B vitamins in Spain. Both taurine and B vitamins are most common in energy drinks but are starting to appear in the dairy category outside of the United States.

The challenge for today’s dairy processors is not to figure out if functional ingredients have potential, but rather to determine which ones can have the greatest impact on their bottom line. The functional foods universe is growing quickly, with dairy well positioned to maintain its leadership role and catalyze innovation throughout the food industry.