In 2008, functional products have taken center stage, and the number of highly successful products continues to grow. Along with the functional products, Greek yogurt, all natural and organic yogurts, and products with innovative flavors should continue to get lots of attention in 2009. As usual, sour cream and cottage cheese have shown their maturity, but not surprisingly some of the growth in these sub-categories has also been centered on new excitement. Functional yogurts have gotten a strong foothold.

We’ll look at these broad trends after we crunch the numbers.

By the numbers

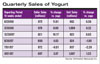

Despite the impact of higher prices, yogurt and other cultured product sub-segments continue to offer growth opportunities.Overall, yogurt sales have been fairly flat, showing just .40% unit growth during the 52 weeks ended Sept. 7. But some of the top brands did significantly better.

Most of the numbers used for this analysis come from Information Resources Inc., a Chicago-based market research firm.

Dollar sales for yogurt have grown almost 10% during the same period. The picture for yogurt actually looks better now than it did a year ago. During the middle of 2007, unit sales actually receded by measurable amounts. But in the most recent three quarters, dollar sales have continued to climb while units grew ever so slightly.

Among the fastest growing brands of yogurt and yogurt drinks are three functional products from Dannon. Activia, which caused a sensation in 2006, continues to grab market share, and is now the No. 5 brand including private label. IRI’s numbers show that dollar sales for Activia were up 25% in the 52 weeks ended Sept. 7, while unit sales grew almost 14%. Activia Light, is a much newer product, but has already jumped to the No. 8 spot.

And Dannon is not the only player in the field. Yoplait and smaller competitors have had their own successful rollouts.

Speaking of Yoplait, the Yoplait Light brand also experienced dramatic sales growth for the period. Dollar sales were up 20% and unit sales more than 13%.

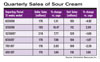

Looking at sour cream sales, dollar sales have seen some sizable jumps, but the drop-off in volume sales had been less dramatic until the period ended June 29, where they dropped nearly 5%.

Refrigerated dips accounted for more than $445 million in sales for the same period, with private label totalling about 20% of that. Most top brands have seen some unit declines, while private label grew slightly. Kraft had double-digit declines by both measures.

Following trends

Today’s food and beverage manufacturers are all trying to capture the public’s growing interest in functional foods. The dairy industry has done an especially good job of enhancing its products with health and wellness benefits. The Mintel Global New Products Database (GNPD) reports that spoonable yogurt was the second most active subcategory among all US functional foods launched in 2007. It was preceded only by meal replacement beverages.Omega-3s have become one of the most visible and influential cultured dairy functional food trends. Consumer awareness of omega fatty acids is growing, and dairy companies have been on the cutting edge of product development in this area. Last year, major brands including Breyers and Blue Bunny launched omega-3 yogurts in the United States.

Rachel’s Wickedly Delicious Yogurt, a brand founded in the UK but introduced to the U.S. in 2007, is fortified with DHA for mental function. This premium line includes such varieties as Vitality Pomegranate Acai, Revive Peach Green Tea with Ginseng, Calm Plum Honey Lavender and Exotic Pomegranate Blueberry.

Dairies have delivered even more forward-thinking innovation.

Apart from beauty foods, a variety of functional cultured trends have origins in other parts of the world but have already migrated to the U.S. Satiety is one of those trends. As consumers move away from extreme diets and toward more moderate, balanced eating plans, satiety has an increasingly important place in weight management plans. In Europe, Nestle has been a leader in this area with its line of satiety drinkable yogurts called Sveltesse (in Spain).

Stonyfield Farm, Londonderry, N.H. continues to innovate, as the world’s largest organic yogurt company. Just one recent example is Stonyfield’s extension of the YoBaby brand to include YoBaby Simply Plain.

Last month Stonyfield announced that it will introduce a line of seasonal flavors in 2009.

Greek yogurt and beyond

“It’s not just a new yogurt. It’s a new category.” This is how AgroFarma Inc., South Edmeston, N.Y., positions Chobani, a Greek style yogurt that contains more than two times the amount of protein (28% to 34% of the Daily Value, depending on the variety) than traditional American yogurts. All-natural Chobani is made using traditional European straining methods to deliver a rich, smooth, creamy texture and full-bodied taste. Chobani also contains five live and active cultures, including three described as probiotics.“As consumers continue to seek out healthier ways of eating, many are adopting the Mediterranean diet, and the rewards couldn’t be greater,” says Hamdi Ulukaya, president of AgroFarma. “People in the Mediterranean region eat an abundance of food from plant sources, and consume yogurt and cheeses that contain lean sources of protein. Their diet, along with plenty of physical activity, contributes to the vibrant spirit we associate with a Mediterranean lifestyle.”

Stonyfield also produces the Greek style line Oikos Organic Greek Yogurt in partnership with Greek yogurt maker Euphrates, makers of authentic old-world foods. Most recently, that line was extended to include Honey and Blueberry flavored yogurt with the same rich, high protein base yogurt.

Today it is available in U.S. natural foods stores thanks to The Icelandic Milk and Skyr Corp., New York, which recreated the authentic process used in Iceland. Varieties include Blueberry, Orange & Ginger, Pear & Mint and Pomegranate & Passionfruit.

There’s also yogurt from Down Under. Wallaby Yogurt Co., Napa Valley, Calif., is a manufacturer specializing in creamy, Australian-style organic yogurt. Made from organic milk produced by small Northern California family farms and using only premium organic fruit, Wallaby Organic is made in small batches, using a long, gentle culturing process. The company says its yogurt takes twice as long to make as conventional yogurts and achieves a creamier taste without using any gelatins.

Beyond yogurt, we also can’t forget about Kefir.

Recently the company put its probiotics into a snack bar. New Kefir Wellness bars come in three flavors: Chocolate, Pomegranate, and Sweet and Salty. n

Product Development Editor Donna Berry contributed to this report.

Fast facts

- Total yogurt sales in the U.S. for 2007 approached $4 billion. In FDM channels (excluding Wal-Mart), sales are up 20% since 2002 in current terms, and up 5% in constant terms. In natural food channels, 2004-06 sales increased 42% in current terms and 34% in constant terms.

- The Hispanic population in the U.S. increased 14.9% and is expected to keep growing. Hispanic respondents report higher rates of yogurt consumption than the sample as a whole (64% vs. 54%). Furthermore, Hispanics are more likely to use yogurt today than they were in 2002 (64% vs. 56%).

- Fruit flavored yogurt is still the most common type eaten. However, data show increasing numbers who eat yogurt that is flavored without fruit (33% in 2006, up from 28% in 2002).

- There were 50 new organic cultured dairy products introduced in the U.S. in 2007, including seven new organic butters.

- Sour cream sales now total more than $750 million and refrigerated dips $445 million.

Simle, Plain

Earlier this year Stonyfield Farm introduced a “baby’s first” yogurt-YoBaby Simply Plain. Made with organic whole milk that provides calcium and protein essential for baby’s proper development, YoBaby Simply Plain also includes Stonyfield’s six live active probiotic cultures to ensure good intestinal health. The product has now moved into full distribution. Each 4-ounce serving is 80 calories and provides 4 grams of protein, or 25% of the Recommended Daily Intake (RDI), and 20% of the RDI of calcium.

The Daisy Brand

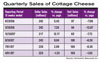

Since the mid 1970’s, Daisy Brand, Dallas, has sold one dairy product: sour cream. Today, it sells two. Daisy Brand introduces cottage cheese in regular 4% milkfat and Low Fat 2% milkfat varieties. Like its sour cream, Daisy cottage cheese is made the “pure and natural” way-the Daisy way-preservative free and with 100% natural ingredients. Ingredient legends are very simple: cultured skim milk, cream, salt and vitamin A palmitate. Products are stabilized the old-fashioned way: a slow process that let’s the cultures do their trick. The end result is what the company claims is a smoother, creamier and fresher-tasting sour cream and cottage cheese.Links

- State of the Industry 2008: Cheese is Convenient, Naturally

- State of the Industry 2008: Ice Cream--Sweet Success

- State of the Industry 2008: Butter--Spreading What's New

- State of the Industry 2008: Changes in the Big Beverage Market

- State of the Industry 2008: Ingredients--Pricey Necessities

- State of the Industry 2008: Introduction

- State of the Industry 2008: Milk--Ups and Dows

- Danisco