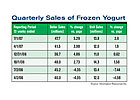

In the 13-week period ended July 1, frozen yogurt sales were up about 5.3% by dollar sales and 2.9% by unit. These numbers are from Information Resources Inc. Frozen yogurt’s resurrection appears to be indicative of an overall consumer tendency toward better-for-you offerings in the frozen dessert aisle. More about that later, too.

And now...for the rest of the segment.

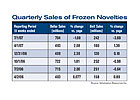

Novelties had been fairly flat going back to early 2006, did a little better in Q1, but then really dropped off in the period ended July 1. Unit sales were down by nearly 4%.The good news about novelties comes in the smaller subcategory of frozen dessert novelties that includes things like ice cream/ice water blends and also among the diet and better-for-you brands. Weight Watchers, for instance has products in both categories and both are experiencing tremendous growth.

Ice cream sales continue to run soft. You have to go back to April of 2006 to find any sustained growth in ice cream. However, the bleeding in the second quarter this year was not quite as bad as the first. For the 52 weeks ended Sept. 9 unit sales slumped by more than 3.5% and dollar sales dropped 2.1%.

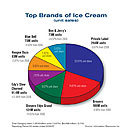

The pie chart at the right depicts the top seven brands including private label determined by market share by units. Only two of those grew unit sales in the period-Dreyer’s/Edy’s Slow Churned and Ben & Jerry’s. So it’s not only better-for-you that’s selling. Just below Ben & Jerry’s, and therefore off the pie chart, Turkey Hill had dollar growth of 14.6% and unit growth of 15.2% for the same period.