Accumulating evidence backs the benefits of probiotics, and if you can get them through food, all the better. Yogurt supplies about 100 million bacteria per gram. Look for labels touting live, active cultures and aim for 100 million and up per dose.

Thank you, Oprah. And thank you again for featuring the book Superfoods Rx: Fourteen Foods that Will Change Your Life by Steven Pratt and Kathy Matthews on your show. The book is based on this simple but profound premise: Some foods are dramatically better than others for health and longevity. Pratt, who is a medical doctor, witnessed the positive results that occurred when his patients with age-related macular degeneration changed their diets to include certain powerhouse foods-foods he has identified as "superfoods." This book identifies 14 of the most nutrient-dense superfoods, one of which is yogurt.

We also cannot forget the recent hype in The Wall Street Journal. The Jan. 27, 2004, edition defines probiotic cultures and prebiotics. A month and a half later in the March 9th edition, the popularity of yogurt drinks was addressed.

Indeed, with publicity like this, yogurt's popularity is sure to continue to boom.

A look at U.S. yogurt production figures from USDA Agricultural Marketing Service shows yogurt's growth record. In 1980, a mere 570 million lbs of yogurt were produced in the United States. Jump to 2002, and you will find that production increased 274.6% to more than 2.1 billion lbs annually.

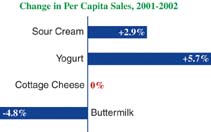

For a product that has been consumed throughout the world for a longer time than the United States has been, well, the United States, yogurt does not have an impressive per capita consumption rate. Data indicates that in 2001, U.S. per capita consumption of yogurt was 7.0 lbs. In 2002, this figure jumped 5.7% to 7.4 lbs. But in Sweden, for example, per capita consumption was 62.8 lbs. Swedes are consuming almost 8.5 times as much yogurt as Americans. You can see where there is a lot of room for growth. Hopefully Oprah's endorsement will get yogurt on an even faster growth track than it is already on.

Excitement in yogurt

Within the yogurt category, yogurt drinks have really shaken up the dairy case in the past five years. Thanks to countless new product introductions, from 1999 to 2003, yogurt drink retail sales at food, drug and mass merchandisers, excluding Wal-Mart, have increased 1,409.6%, according to ACNielsen. From 2002 to 2003, this category has grown 104.7% to $268.7 million. And remember, these are just retail sales. This figure does not include any foodservice venues, nor does it take into consideration sales from convenience stores or club stores, all of which are significant channels for yogurt drinks, particularly since the majority of yogurt drinks are sold as single-serve items, and this is very attractive to impulse buyers.A study by Euromonitor does take into consideration other sales channels, and reports drinkable yogurt sales at $460 million in 2003. By 2008, this figure is projected to grow 31% to about $603 million.

Leading national players in the yogurt drink sector include General Mills Inc., Minneapolis, with Nouriche; Stonyfield Farm, Londonderry, N.H., with Smoothies and YoBaby Drinkable; and The Dannon Co., Tarrytown, N.Y., with four product lines: Danimals, Frusion, Light ‘n Fit Smoothie and DanActive. Paris, France-based Groupe Danone, the parent company to Dannon owns 80% of Stonyfield, which makes Danone the leading yogurt drink marketer in the United States.

Assistance from overseas might be what the probiotic segment of the U.S. yogurt (cup and drink) business needs, as Americans, unlike Europeans and Asians, continue to get squeamish when discussing gastrointestinal health.

Dannon's DanActive, the only true U.S.-made "shot of probiotics" has had an interesting ride in the United States. Debuting in 1999 in a Denver test market under the brand that the rest of the world is familiar with-Actimel-today, DanActive is available nationally through select natural foods store chains including Whole Foods Market Inc., Austin, Texas. The latter is a result of the relationship Dannon has with Stonyfield and the distribution Stonyfield has with Whole Foods.

Stonyfield has been busy itself. The single-serve organic Smoothie line now includes a vanilla flavor, which, to date, is a category exclusive. Also, the tropical fruit flavor was replaced with tropical banana.

As the forerunner in cup yogurt designed for babies with the YoBaby line, Stonyfield launched the first yogurt drink for babies appropriately called YoBaby Drink. Unlike the grown-up version, YoBaby Drink comes in 24-oz recloseable bottles so that parents can pour some into a sippy cup and serve. In fact, Stonyfield offers a special sippy cup promotion on its bottles.

Lastly, because little ones like excitement in their flavors too, Stonyfield rolled out YoBaby Cup Yogurt Peach & Pear, a new variety pack that has pear replacing vanilla in the original multi-pack combination.

Low-carb cultured products

It is impossible to discuss trends in food product development without mentioning the most popular concept out there: Foods described as "low-carbohydrate." Keep in mind that no food can be legally described as low-carbohydrate, as no Daily Value exists for carbohydrate. Consequently, FDA-defined terms such as "low," "reduced" or "free" cannot be used to describe the carbohydrate content of any food. Nevertheless, formulating foods that complement low-carb lifestyles is quite the trend, and this is true for cultured dairy foods, specifically yogurt products.While SouthWest Foods, Tyler, Texas, was the first to market a regional low-carb cultured dairy product-LeCarb YoCarb-it is Dannon's Light ‘n Fit Carb Control cultured dairy snack that is selling out in supermarkets across the country. Light ‘n Fit Carb Control comes in four flavors-Peaches n' Cream, Raspberries n' Cream, Strawberries n' Cream and Vanilla Cream-with a single 4-oz serving containing 3g carbohydrates and 80% less sugar than regular low-fat yogurt.

The question many in the industry ask is: Are low-carb lifestyles here to stay, or are they just another fad? Well, according to one of the largest public opinion surveys ever on low-carb diets, it looks as if low-carb is a revolution, one that will dramatically impact the food and beverage industries. The low-carb lifestyle is no passing fad.

Conducted by Opinion Dynamics Corp., Cambridge, Mass., with results released in February, the survey of 1,800 U.S. adults indicates that there is a shift taking place in American eating habits. The study shows that 20% of adults have tried a low-carb diet since 2002 and 11%, which is about 24 million consumers, are currently on a low-carb diet. This figure is much greater than industry analysts had previously estimated. Interestingly, 19% of survey respondents-about 44 million adults-who are currently

not on a low-carb diet are "very" or "somewhat" likely to try one in the next two years.

This is important information for product developers, as more con-sumers will be counting carbs, and therefore, formulators should strive to keep "net carbs" low in future product development efforts. The term net carbs refers to the total amount of carbohydrates that negatively affect (i.e., increase) blood sugar and insulin.

Marketers take note, too, as the survey shows that consumers rely on low-carb brand labels, packaging and advertising when selecting food items. Two thirds of consumers currently on low-carb diets told Opinion Dynamics it is "very" or "somewhat" important to them that a food item has a specific low-carb brand label when they make purchasing decisions.

For labeling purposes, not everyone wants to go "low-carb." This is because in order to reduce carbohydrates low enough to attract die-hard low-carb dieters, lactose must be removed from the milk. When lactose is removed, milk is not "milk" according to Federal Standards of Identity. Nor is yogurt yogurt anymore. Some manufacturers and marketers are opting for the "light" route, which has formulations making use of non-nutritive sweeteners, but the lactose is still present.

This is the case for the first light yogurt drink in the U.S. marketplace. In February, St. Paul, Minn.-based Old Home Foods debuted Old Home Light Yogurt Smoothie. Fat-free and sweetened with sucralose, an 8-oz bottle contains less than 100 calories and about 11g net carbs. And at press time, General Mills was getting ready to launch a lighter version of Nouriche appropriately named Nouriche Light.

Also, blending non-nutritive sweeteners with traditional caloric sweeteners is an approach being used to simply lower calories, particularly in yogurts for children. We are in the midst of an obesity crisis, and one tactic to remedy the situation is to reduce calories. For example, this past summer, Wells' Dairy Inc., Le Mars, Iowa, rolled out Disney Swirl'n Magic yogurt. Using sucralose, Wells' Dairy is able to flag the following statement on package labels: 50% less sugar than other leading brands of kids' yogurt.

The time is now for probiotics

In the United States, Stonyfield is likely the most innovative-in terms of use and marketing-when it comes to probiotic cultures, as all of Stonyfield's products contain "beneficial probiotic bacteria." However, DanActive is the most authentic probiotic in its "single shot-style dose" bottles.In Canada. Bio-K Plus International Inc., manufactures and exports into the United States an impressive shot-style dairy drink sold under its namesake: Bio-K+. Bio-K+ is made using a patented strain of acidophilus that the company says is never freeze dried, which helps it survive stomach acid and remain active through the intestine. Bio-K+ is described as "the ultimate probiotic," as one 3.5-oz bottle contains 50 billion acidophilus cultures.

If Americans have been slow to jump on the yogurt wellness wagon, how can the industry expect Americans to accept the concept of good bacteria for intestinal health? Indeed, consumer understanding and acceptance of probiotics has been a slow ride, but many experts in the industry say the time is right, as Americans, in their pursuit of wellness and health, are ready to roll out the red carpet for beneficial bacteria.

After all, researchers are progressing on their understanding of the role of beneficial bacteria. For example, researchers at the Southeast Dairy Foods Research Center, Raleigh, N.C., are using genome studies to figure out how to tailor probiotic functionality in dairy products to human health needs. And researchers at the Minnesota-South Dakota Dairy Foods Research Center, St. Paul, Minn., are using a process known as gene-mapping to increase the longevity of the beneficial bacteria culture in yogurt once it leaves the grocery store.

Also at the Minnesota-South Dakota center, researchers have formulated a new probiotic yogurt using acid whey powder. According to a consumer panel of both frequent and sporadic yogurt eaters, both groups were highly satisfied with the taste and texture of the new acid whey powder yogurt, which uses acid whey solids from cottage cheese production to replace a portion of the nonfat dry milk.

There are a number of advantages to adding the acid whey to yogurt. For starters, the acid whey produces yogurt that is rich in protein. Also, acid whey has a high concentration of calcium, which is important for building bones. It also contains predigested nitrogen, which can improve the growth and viability of helpful bacteria found in probiotic yogurt.

The technology can benefit manufacturers of both cottage cheese and yogurt. Processors can use the acid whey generated during cottage cheese manufacturing to adjust protein levels in milk for yogurt manufacturing.

The other categories

While there is so much to say about yogurt, yogurt drinks and probiotics, there is almost nothing to report on the other cultured dairy foods categories. There have been virtually no new sour cream products introduced this past year, yet per capita consumption is up 2.9% thanks to increased use of sour cream in foodservice, primarily as a condiment on Hispanic-style foods.There have been some flavor innovations in the dips category, including Roasted Tomato Red Pepper Dip from Westby Cooperative Creamery, Westby, Wis. This dip is so hearty it can actually be used as a pasta toss in addition to a chip dip. In fact, alternate uses for dips are helping drive per capita consumption. According to USDA, Economic Research Service data, per capita consumption of sour cream and dips, combined, was 3.6 lbs in 2002. This is a 33.3% increase from 1992. Many opportunities exist for sour cream and dips based on usage occasion, flavor and package. For example, dairy processors have single-serve bottles for milk. Why not manufacture a less viscous ranch-flavor sour cream dip and bottle it as a "fresh" salad dressing?

The last two cultured categories to note-cottage cheese and cream cheese-are both sleepers. It appears with all the excitement in yogurt, marketers are ignoring these product lines. Per capita cottage cheese sales are flat, while retail sales are down 1.5%. Cream cheese, which in recent years benefited from the popularity of bagels experienced a 1.0% decrease in retail sales. This decrease was probably even greater in foodservice as a result of bagels being labeled taboo by low-carb dieters.

Low-carb lifestyles, the obesity crisis and consumers' pursuit of wellness and health will continue to influence product development in the cultured products category the next few years. And, who knows what will be after that? Stay tuned...

Sidebar: Innovations Abroad

Europeans consume around 10 times the amount of yogurt and yogurt drinks that Americans do. As a result, there is more variety overseas, as well as more manufacturers willing to innovate. Here are some interesting items from abroad.Mona GmbH, Austria, markets Well & Active, milk and fruit juice (apple, mango and tropical light) drinks that contain probiotic cultures. Through the brand name and label declaration of "probiotic milk," consumers are aware that this beverage is associated with wellness.

In Germany, Group Danone targets kids with FrumixX. This fermented milk and fruit juice blend (6% of apple juice, orange juice or strawberry and cherry juices) also contains whey.

Swiss-based Emmi markets Benecol Dairy Drink, which is low-fat yogurt, fruit juice and plant stanols. The plant stanols are associated with lowering cholesterol. The company also has a cup yogurt that contains aloe vera, which claims to reduce the signs of aging by beautifying facial skin.

Sidebar: National Players in Natural and Organic Yogurt Emerging

David Phillips Chief EditorThere was a time, not so long ago, when marketing natural and organic cultured dairy products was almost entirely a regional business. Sure, Stonyfield Farm, Londonderry, N.H., has had national reach for some time, and Horizon Organic has grown its yogurt business, along with its milk, into a coast-to-coast brand from its Longmont, Colo., base.

But 10 years ago, Stonyfield wasn't doing much in the California market where the homegrown favorite Brown Cow had established a flourishing business in the natural foods store channel. And up the coast in the Pacific Northwest, the Nancy's brand, sold by Springfield Creamery, Eugene, Ore., reigned supreme.

While the natural and organic yogurt business remains quite regional, the makings of a competitive national market have emerged. Brown Cow, Antioch, Calif., which has long been the No. 2 natural brand, is now owned by No. 1 Stonyfield, which is 80% owned by Groupe Danone. Horizon runs a close third behind Brown Cow, and although Nancy's has less market share than some regional and specialty brands, it now has products in all 50 states.

With the demand for natural and organic products fueling an evolution of those products' retail environment, the stage is being set for full-fledged national competition.

Stonyfield is huge in mainstream supermarkets, and with the Brown Cow acquisition it now operates plants on each coast. The strategy is to build its namesake brand and Brown Cow simultaneously, with complimentary products. Horizon Organic is now 100% owned by Dean Foods, a $9 billion company which knows a thing or two about growing national brands.

"As the customer base expanded, all of these products became more accepted and found their way into the mainstream, and now some very large companies have gotten involved," says Sue Kesey, who in 1970 launched the Nancy's brand with her husband Chuck. "The good side to that is that those large companies are now making better kinds of food. But the other side is that we are all competing for a fairly limited shelf space."

Still, Kesey says there is no reason why brands like Nancy's, Horizon, Stonyfield and Brown Cow can't share shelf space. While noting that the natural foods business

still has a lot of regionalism to it, she acknowledges that there is a change underway in national chains like Whole Foods and Wild Oats, and those changes motivate expansion among the manufacturers.

"I think it's important to them that a product be available in all regions," she says. "They like to have a core set that looks the same."

Gary Hirshberg, Stonyfield's president, cautions that going from regional to national may be more difficult than it was 10 years ago when Stonyfield did it.

Stonyfield, which is now a somewhat autonomous division of Danone, France, did more than $140 million in sales last year, compared with Nancy's $9 million, and while the market has expanded exponentially, Hirshberg says the positioning of the brands has been fairly constant. But in a segment that's growing by more than 10% a year, there is plenty of opportunity for rapid growth.

Kesey says it's important for Nancy's yogurt, cottage cheese and cream cheese products to remain a "benchmark of naturalness." The products are sweetened with fruit and sometimes honey rather than with cane sugar, and Nancy's even processes its own fruit to ensure purity.

The key to spreading Nancy's geographic market however has been a strengthening of its relationship with an evolving network of natural foods distributors, United Natural Foods International.

It should be noted that Wholesoy and White Wave cultured products are also sold nationally, as are the kefir products of Lifeway Foods, Morton Grove, Ill. Other regional companies that could soon reach the critical mass needed to go national include Wallaby Yogurt, Napa Valley, Calif., Cascade Fresh, Seattle, and Redwood Hill Farm, which makes goats milk cheese and yogurt in Sonoma, Calif.