"Intense Vanilla is my favorite flavor," the 6th grader says after she fishes the bottle from the machine and starts to drink it. "If I have money, this is what I usually buy from the machine. Sometimes I buy water or NesQuik."

Bill Neuman, an 8th grader at the same suburban Buffalo school prefers Intense Chocolate. Both children say they would just as soon drink soft drinks as flavored milk, but Sydney says her parents don't let her drink pop. The students at Mill Middle have the option to buy flavored milk from a machine in the school cafeteria thanks to Upstate Farms Cooperative, Buffalo.

"Now we're selling about 30 cases a week," she says.

"We are so glad to see that it's working," adds Kathy Christopher, Food Service Director for the 13-school Williamsville district. "It's a little scary to have that initial outlay of $4,000 on something that's so new. It's great to see it pay off."

It's paid off for the school district, which is offering healthier alternatives and making a bit of money for its programs. It's paid off for Upstate Farms, which fills about 50 machines in the western N.Y. and has stoked its product development efforts thanks in part to its vending program. Intense Mocha Java, with "Caffeine Kick" on the label does well in college campus machines.

While milk sales can be trickier to read than tea leaves, innovative marketing approaches like vending are giving processors opportunities to increase sales and margins, while getting the most important consumers excited about milk.

"Vending has been a real success story of the national program, says Tom Nagle, v.p. of marketing at the International Dairy Foods Assn. (IDFA). "The board took what felt like a big risk in investing a lot of money to try to figure out how it could be done. There was nobody in the milk or the vending businesses who felt like this could be done."

By the numbers

Even the optimistic dairy observer would have a hard time deciding if the glass is half-full or half-empty when 2001 and 2002 sales figures are examined.USDA data show that overall packaged milk sales were up 0.3% in the first nine months of 2002. According to Information Resources Inc., overall sales of milk for supermarkets, drug stores and mass merchandisers, excluding Wal-Mart were up 0.6% by volume for the 52-weeks leading up to Dec. 1, 2002, but dollar sales were down 1%. These figures also do not include convenience stores or vending.

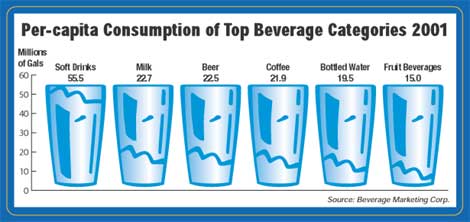

IDFA's 2002 edition of Milk Facts concludes that 2001 sales were down by just less than a percentage point, but also indicates growth in certain product types and in certain age groups. The 2002 report Milk and Dairy Alternative Beverages in the U.S., from Beverage Marketing Corp. also notes those gains, but looks more specifically at the dogged overall per-capita consumption losses and the end result - the first five year period of decline (1996-2001, down -0.4%) since 1980. Last year, that same figure seemed to hold more promise, as the Compound Annual Growth Rate for 1995 to 2000 was expected to come in at 0.3 but that figure has since been revised to zero growth, which matched the 1990-1995 period. Per-capita consumption is now down to 22.7 gals.

No matter whose numbers you look at, flavored milk is performing well. The most recent figures from IRI show a jump of 5.5% in dollar sales and 2.5% in volume for flavored milk, eggnog and buttermilk during the 52 weeks leading up to Dec. 1, 2002. Beverage Marketing Corp. reports that flavored milk was up nearly 6% in 2001 and that flavored milk now had a 6.6% volume share in 2001 compared to 4.7% in 1995.

Both IDFA and Beverage Marketing Corp. point to the Share of Intake Panel data which show per-capita consumption by children 6 to 12 growing for two years in a row. IDFA says the 28-gal average is the highest for the age group in 10 years. Teen milk consumption climbed 3% in 2001, the first jump in six years for that age group.

Taking On Food Service

Just down the road from where Upstate Farms is headquartered, a big-name partnership is pushing the envelope of single serve milk. Horizon Organic, Boulder Colo., is working with co-packer Steuben Foods in Elma, N.Y. to produce organic milk in Tetra Pak's new Prisma package. The milk is organic, it's aseptic, and the 8-oz package has a flashy appearance that resembles an aluminum can."The milk category in single-serve has been a phenomenon," says Laura Coblentz, director of Marketing at Horizon. "We thought it would be great to have an organic option in single-serve milk. We looked at a lot of different things, and we felt the Tetra Pak Prisma was the best option. It provides us with great product quality without having to use any preservatives, it's also a great package for graphics, we liked the octagonal shape, and we could put a straw in it and it's fun."

Steuben has worked with Horizon for a number of years, as one of the co-packers of Horizon's ultrapasteurized organic milk. (See related story below.) And Horizon had approached Tetra Pak, of Vernon Hills, Ill., to design a package. While Steuben and Horizon already had a relationship, Steuben is also a partnered co-packer with Tetra Pak, which has historically worked to establish co-packer partnerships which allow companies like Horizon a bit of one-stop shopping for packaging and processing solutions.

"We showed them what we were doing and they said ‘we have to have that for our stores,'" Coblentz says.

"What happens is that they have parents coming in in the morning and they have kids with them and there isn't much for the kids. This gives them something for the kids."

The Horizon organic white, strawberry and chocolate are selling coast to coast in supermarkets, natural food stores and nearly all 3,000-plus Starbucks locations. Strawberry multipaks may soon be sold at ambient temperatures in club stores and vending opportunities are being considered. More flavors may also be in the works. For the strawberry milk, no color is added.

While a Horizon-Starbucks combination has great brand appeal, it represents something else too. "Horizon is a great example of a huge opportunity, which is foodservice," says IDFA's Nagle. "In food service we have 90% penetration and less than 3% of sales. Which means we are everywhere but nowhere."

MilkPEP is out to change that, Nagle says, and it is launching a foodservice campaign that may have even more potential than vending.

Facing the competition with innovation

Milk is not sold in a vacuum, of course, and to a greater extent each year, it is sold right next to other beverages. There are a number of examples of how dairy is working to steal market share from other segments by re-inventing milk. Here are just a few:

- Industry-leader Dean Foods recently received approval to distribute and sell its Hershey's and Jakada Products at ambient temperatures. Dean's value-added division, Morningstar Foods plans to broaden points of sale and take advantage of newfound distribution opportunities through this innovation.

- Bravo! Foods, the entrepreneurial company behind Looney Tunes Milk is taking flavored milk to a new level by drastically improving its nutrition profile. Sweetened with Splenda® and fortified with extra nutrients, the new Slim Slammers line from Looney Tunes has tremendous potential. Bravo! is also hoping to take advantage of Tetra Pak's efforts to develop an aseptic plastic bottle.

- MAC Farms, Inc., Burlington, Mass., has received USDA approval to sell its carbonated milk product e-MOO in school cafeterias. This took place at about the same time that the Los Angeles Unified School District voted to ban carbonated soft drinks from all its schools. Mac Farms is also rolling out two related products in Walgreen's drugstores across the country.

- Dairy Farmers of America has introduced National Milk, aseptic chocolate milk in 11 oz. Aluminum cans.

- In the Midwest, Swiss Valley Farms cooperative has become the first major dairy processor to add Deja Moo to its product line. Deja Moo is a unique branding, packaging and marketing concept for white and flavored milk that is aimed primarily at traditional grocery store channels

"We continue to have things in the pipeline, which gives me a lot of encouragement," Dryer says. "We have done a lot and we are not sitting on our laurels, and that's a real sea change for this industry. We haven't seen any results yet, but Dean's new ambient bottle is a major plus from a distribution standpoint, and I think that will really pay off."

If milk is ready to compete with other beverages, just what will it find as it enters the larger universe of beverages? Well, currently it's a market where most beverages are having a hard time staying afloat while the most basic beverage of all is growing by leaps and bounds.

For non-dairy beverages that are produced by dairy processors, growth has also been slow with a couple exceptions.

"Soy is doing well. It's off a small base but growing dramatically," Hemphill says. "In juice, people are opting for convenience. More often than not 100% juice is being sold chilled, and fruit drinks are being sold stable. Teas had some up tick a couple years ago with the proliferation of nutrient enhanced teas.

"If you dig down beneath the surface in any category you can find success stories," Hemphill says.

For milk that may mean new channels like vending and foodservice, as well as new and exciting products. It could also take the form of branding and marketing, whether it's done by industry leaders like Dean Foods and National Dairy Holdings, or independent dairies and cooperatives with things like Deja Moo. The groundwork has been laid, and it's now up to the processors to bring it home.

Sidebar: Swiss Valley Farms Launches Deja Moo

For Jim Odney and his Deja Moo® concept, someone had to take a chance. That someone turned out to be Davenport, Iowa-based Swiss Valley Farms, which took a chance by becoming the first major dairy to rollout Deja Moo milk.Odney has spent the last few years promoting Deja Moo through his American Dairy Corp., Minneapolis, while at the same time running Schultz Creamery in Bismark, N.D. Several large dairy companies were impressed by the pilot work Odney had done with Deja Moo at Schultz, but none took the leap to the branding, packaging and marketing program that is Deja Moo.

Swiss Valley was cautious too, but decided to give it a try, and having launched in Dubuque last November, the company is excited about the results.

"It has grown our milk volume and it continues to sell," says Swiss Valley CEO Gene Quast. "It sold out so quickly that we were running back with specials to restock it."

Under the Deja Moo program, Swiss Valley puts its 2% and chocolate milk into 1.5 and 3 liter Deja Moo bottles. Local color newspaper ads entice customers with the edgy package and label design and marketing sizzle. The dairy pays a licensing fee to American Dairy Corp.

"We have been able to take away space from the other guys," he says.

Retailers were thrilled with the idea, Quast said, and the company will continue to introduce Deja Moo in new markets.

Odney said the launch exceeded his expectations too. He used what he refers to as a guerilla marketing approach to create the initial interest in the product.

"We buy a 60-second live radio spot, but I go in and introduce myself to the on-air personalities and bring them some milk," Odney says. "They turn it into 2- or 3-minute dissertations about flavored milk."

Odney said he is in ongoing discussions with a number of other processors who are interested in licensing Deja Moo.

Sidebar: Horizon Organic Applies Tetra Prisma Technology at Steuben Foods

Horizon Organic's single serve milk is sold at thousands of retail outlets, including many Starbucks coffeehouses, across the country, but each little package comes from a single plant in Elma, NY.Steuben Foods was born in 1982 as a specialty dairy spin-off of Elmhurst Dairy, a Metropolitan New York full-line dairy. The Elma plant was completed in 1985 (it was honored in 1987 as Food Engineering magazine's new plant of the year), to produce extended shelf life yogurt and pudding products.

"Back in 1978 Elmhurst Dairy, working with Kellogg Foods launched Le Shake, a drinkable yogurt that was way ahead of its time," says Ken Schlossberg, president of Steuben Foods, Jamaica NY.

The partnership with Kellogg led to an effort to develop Whitney's yogurt (an extended shelf life cup yogurt that could be manufactured from a single point, but marketed nationally) and was the driver for the Elma, plant.

The facility consists of more than a dozen aseptic lines including ten Tetra Brik lines and two new Tetra Prisma lines.

It's those Prisma lines that are used to run the Horizon product. The process and core equipment of the Prisma line differs little from the Tetra Brik. The milk is processed with a VTIS system, the chocolate and strawberry milk having first been batch mixed. From there, product is stored in dedicated aseptic tanks before filling. The two dedicated Tetra Prisma fillers are housed in a clean room. The fillers are built on the same platform as the Tetra Brik machines but with some modifications. As with the Tetra Brik, the packaging material is roll fed, sanitized and then filled before the individual units are cut and sealed.

The Horizon Prisma packages include a foil seal that can either be pulled open for sipping or punctured with a straw. Straws are attached downstream from the filling prior to the application of a registered overwrap for three-packs. Those three packs are then put in corrugated cases, which are palletized for shipment.

Steuben Foods produces a wide range of shelf -stable products including chocolate beverages, puddings, nutritional supplements and soy milk.