Photo courtesy of DeLaval.

Photographer Björn Qvarfordt.

Photographer Björn Qvarfordt.

Refrigeration requirements are one of milk's greatest obstacles to getting into new sales channels. When this barrier is removed through the use of shelf-stable processing and packaging, milk is distributed and merchandised alongside the competition. Milk now has a better chance of being a consumer's obvious beverage choice.

Adding value to shelf-stable milk further increases its "obvious choice" chance. Shelf-stable, value-added 100% milk includes flavored varieties, designed for specific age groups or cultural preferences. For example, a bubble gum-flavored milk can be marketed to kids, whereas a coffeemilk product can be designed to be more adult oriented. For Hispanics, a mango-flavored product may be appealing, while Asians may be interested in a green tea flavor.

Such 100% milks actually have value added twice: once by being processed and packaged to be shelfstable and again through the addition of innovative flavors.

To clarify, there are two categories of value-added milk: 100% milk (a focus of this research) and milkbased drinks, which include beverages with a minimum of 51% milk, such as lattes, nutritional drinks and smoothies. Like 100% milk, valueadded milks can be fresh, extended shelf-life or shelf stable.

Marketers who add value to their shelfstable

milks have great potential to grow

their milk business, as such products

appeal to today's consumers' on-the-go

needs. Value comes in the form of flavor,

marketing and package.

What does shelf-stable mean to consumers?

Dairy Management Inc.™ (DMI), Rosemont, Ill., along with its research partner Beverage Marketing Corp. (BMC), New York, conducted exploratory qualitative focus groups to better understand the current shelf-stable milk market, including consumers' attitudes and perceptions. DMI also investigated the business hurdles in distributing these products across all relevant supply chains. It is from these findings that DMI identified value-added 100% milk as one of the best growth opportunities for shelfstable milk."The most overwhelming finding from this exploratory research was the fact that consumers just do not know what shelf-stable milk is. If they do know it exists, they have varying expectations," says Julia Kadison, BMC vice president. "Findings suggest that the greatest opportunity for shelf-stable milk is all about the value it adds to the supply chain."

The strategic area of focus for this research was shelf-stable 100% milk, which included all fat levels of white milk, as well as value-added milks.

Nestlé's new shelf-stable Nesquik makes flavored

milks and milkshakes readily available for graband-

go thirst quenching from vending machines.

High-potential targets

"Previous research findings identified three types of consumers who are high-potential marketing targets for shelf-stable 100% milk," says Kadison. "Two of the groups- white-Anglo moms and Hispanic moms-buy lots of refrigerated milk for their heavy-user milk households. The third high-potential group is adults with no kids in the household who are moderate to heavy milk consumers."Our findings identify the core market for traditional white shelf-stable milks to be moms buying for themselves and their families. Ethnicity was not a factor for shelf-stable milks," says Kadison. "The highest need or demand exists with heavy-user milk households."

DMI's Executive Vice President for Strategic Planning and Business Development Barbara O'Brien adds, "Heavy levels of milk consumption are driven by the presence of kids, especially young kids in the 1- to 7-year-old range who love milk and have fewer beverage alternatives than older kids or adults."

After it was explained to the heavy milk-user group that traditional shelfstable milk is the same milk as in the refrigerated case, simply processed at a higher temperature and aseptically packaged, some were open to the idea of keeping such milk on hand for emergencies. "For example, sometimes ‘nothing but milk' will satisfy certain need-states such as with coffee or cereal, or in a nighttime bottle for babies," says O'Brien.

Sweden's Arla Foods

markets shelf-stable, valueadded

flavored milks and

milk drinks in glass bottles.

The bottles are sold individually

or they can be mixedand-

matched into four

packs. Cases are also available

for secondary sales or

in-home stocking up.

Value equals growth

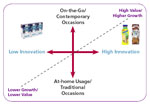

For this study, BMC categorized shelf-stable 100% milks by their level of value-value in terms of flavor, marketing and packaging. (See diagram on page E.) Low-innovation products are mainstream shelf-stable milks, which tend to be of the white or chocolate varieties, and come in shelf-stable, single-serve and multiserve containers.High-innovation products are where the growth opportunities exist. These shelf-stable 100% milks are higher-value products. They tend to be packaged in plastic or multilayered paperboard containers, such as prism-shaped cartons. Flavors may include white and chocolate; however, the real opportunity that shelf-stable processing and packaging brings is the reduced risk in offering more innovative flavors, often tied to licensed brand names.

"The real growth opportunity is with the value-added products. Consumers simply view this product differently," says Kadison. "Retailers also know how to merchandise these products-alongside other singleserve beverages in impulse coolers as well as in the refrigerated dairy case. Having these products in coolers will help them gain awareness among consumers. Eventually, these products can be sold in multi-packs, in the soda case aisle and in club stores, where shelf-stable, valueadded dairy-based drinks are already showing success."

Opening new channels

DMI and BMC identified four ways processors can grow their business when they begin marketing shelfstable, value-added 100% milk products."Vending is the greatest opportunity," says Kadison. "Milk that requires refrigeration is very limited by most commercial vending operations. With shelf-stable milk, the product is treated the same as soft drinks." All those vending machines from which soft drinks are being eliminated can be stocked with shelf-stable, valueadded 100% milk.

"Another opportunity is in opening new channels of distribution, such as foodservice accounts that do not have a lot of refrigerated storage space," she adds. "If multi-packs are sold in the ambient-temperature aisle at club stores, where many small foodservice accounts shop for product, these drinks can show up in mom and pop cafes and corner stores."

With a significantly longer shelflife than fresh milk (sometimes as great as 10 times longer), processors reduce their chances of product going past code date. This provides them with more time to move innovative flavors of milk. "They can do a run of caramel-chocolateflavored milk and have six months to sell the bottles," Kadison says. "In the past, they had about 15 days."

The last noteworthy growth opportunity is to target specific consumer segments through flavors and marketing tactics. "The same theory holds as with uniquely flavored products: risks are reduced with the lengthier shelf-life," says Kadison. For example, manufacturers can introduce products in kid-friendly flavors or others geared to more sophisticated adult tastes.

Retailers and foodservice distributors are getting a "taste" for shelfstable, value-added 100% milk. They have noticed how these products can be profitable for them. While they build the demand, processors need to build the supply.