An investment in the innovation of

milk-both the product and the package-

better positions milk to be the preferred

beverage that consumers reach for.

Seven Major Beverage Need-states -

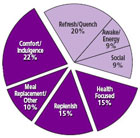

This chart indicates the percentage of time a beverage is consumed for a specific need-state. The exploded part of the chart shows the segments where milk has a significant opportunity to gain share. These represent 62% of total beverage consumption.

This chart indicates the percentage of time a beverage is consumed for a specific need-state. The exploded part of the chart shows the segments where milk has a significant opportunity to gain share. These represent 62% of total beverage consumption.

Right now the answers often guide them to choose soda, juice or water. But with new beverage consumption patterns research from Dairy Management Inc.™ (DMI), Rosemont, Ill., and the commitment from dairy processors to develop milk and milk-based products that answer those questions, the choice of consumers can be milk.

"Consumers' lifestyles continue to change, driving their desire for new beverages, including milk, in new packaging and in new places," says Barbara O'Brien, executive vice president, strategic planning and business development at DMI. "The value-added milk initiative provides preliminary insights to help the industry find-or create-those opportunities."

DMI conducted an in-depth segmentation study in April 2006 involving 3,000 consumers. A goal of the study was to identify the key occasions on which one consumes a beverage. In addition, the survey report offers insights into how milk and dairy-based beverages can better address those occasions through package, process and product development and marketing and merchandising efforts.

"Segmentation identified a broad range of consumer need-states for a beverage, and for which value-added milk can be the obvious beverage choice for today's consumers," says O'Brien. "Need-state, as defined in this study, is the desire for an item that is based on a particular time, situation or lifestyle choice."

From the seven need-states uncovered, DMI identified four needstates as having great potential for value-added milk: Health Focused, Replenish, Meal Replacement/Other and Comfort/Indulgence. (See pie chart above.) These are the segments where milk has a significant opportunity to gain share, and together, they represent 62% of total beverage consumption.

"We need to better understand consumers' needs and expectations of meal replacement products," says Mike Stammer, Ph.D., DMI vice president, strategic insights and evaluation. "As we explore both beverage and food products in this category, we believe there is a great deal of opportunity for milk and dairy ingredients to be more utilized in the meal replacement business."

DMI will conduct further research into

the meal replacement platform. Milk and

dairy proteins readily combine with selected

ingredients to round out the nutrition

profile of on-the-go drinkable meals.

Adding value to milk

Milk processors can take various approaches to adding value to milk so that it can compete successfully against other beverages. DMI's definition for value-added milk-milk in new flavors, with extra nutrients, in on-the-go packages or with new purposes that address people's lifestyles- is based upon how consumers view the product.Value-added milk is broken down into 100% milk products, which includes products made with 100% milk with specific benefits such as flavoring, reduced lactose, extra nutrients and single-serve bottles, and milk-based beverages, which are beverages where milk is a key ingredient, but less than 100%. This includes drinks described as lattes, nutritional drinks and smoothies.

"We have gained insight into highly opportunistic occasions, insight that processors and manufacturers can use today, right now, and start developing beverages that help milk gain back market share," says Gail Barnes, Ph.D., DMI vice president, business development, fluid innovation. "We know who is consuming certain types of beverages at specific occasions . . . and why they have chosen that beverage, in other words, what their needs were for that state. We also know the percent of consumers open to choosing a value-added milk beverage instead of the beverage they currently are drinking."

Barnes adds, "DMI has been able to identify where the opportunities are for value-added milk and how dollar sales of milk can grow if valueadded milk products are available for these specific need-states."

"Many consumers are already drinking milk for specific needstates," says Stammer. "But milk possesses many of the key attributes consumers are looking for during specific need-states, and until now, these have been underleveraged."

For example, as seen in the above pie chart, 15% of all beverage needstates are Health Focused. In this segment there are two sub-segments: Confident/Athletic and Health Management. Let's explore research findings on the Confident/Athletic beverage consumer.

This consumer skews younger in years, leads an athletic, self-conscious lifestyle and is concerned about being fit and healthy. He (62% of this segment) or she (38%) works out regularly, spends a lot of time outdoors and leads a very active social life.

The Confident/Athletic consumer usually drinks beverages during the day time, including before and after working out. Beverage needs include the desire for more functional benefits such as providing energy, enhancing sports performance and helping lose weight. This consumer is looking to feel invigorated, empowered, confident, focused, adventurous, impressive and knowledgeable. The drinks this person chooses tend to be fruity, pure and organic. The beverages contain vitamins and come in a variety of flavors.

"Milk is all of this, and more," says Greg Miller, DMI executive vice president, science and innovation. "The proteins in milk provide energy and specifically, the branched chain amino acids assist with the maintenance and building of muscle tissue, including the repair of muscle after exercise."

Milk, of course, is the ideal carrier for vitamins and other nutrients, and blends well with all types of flavoring systems, including fruit purees.

These are beverage

need-states in which

milk has an opportunity

to become the obvious

choice for consumers. A

need-state is the desire

for an item that is based

on a particular time, situation

or lifestyle choice.

DMI has collected a great deal of information through this segmentation study and will continue to develop and refine insights into specific consumer segments, such as that of the burgeoning Baby Boomers. The key now lies in partnering with industry to put such insights into use.

"This consumer insight, combined with DMI's wealth of dairy science expertise, provides beverage manufacturers and marketers with the tools to innovate numerous value-added milk products," says Jeff Kondo, Ph.D., DMI vice president, product innovation. "DMI can provide product, process and package know-how for innovative value-added milk concept development and screening."

HP Hood LLC, Chelsea, Mass., is committed to innovation. "We are pleased to be engaged in a strategic partnership with DMI with the objective of growing milk consumption," says Barry Boehme, vice president of marketing at Hood. "This relationship leverages complementary knowledge, expertise and capabilities of the two organizations in an attempt to get more done faster and more efficiently.

"The focus of Hood's efforts in applying findings from this research will be on new product development and commercialization," Boehme adds.

Hood's commitment to innovation takes on many forms. For example, in late September, Hood entered into a six-year production agreement with Bravo! Foods International Corp., North Palm Beach, Fla., a brand development and marketing company that promotes and distributes vitamin- fortified, flavored milk drinks. Under the terms of the agreement, the parties have agreed to annual volume commitments of 70 million bottles of various lines of shelf-stable, singleserve flavored milk beverages from Bravo! Foods.

Hood is one of only three dairy processors in the United States that has USDA approval to produce shelfstable milk in plastic bottles.

"Innovation is key to growing sales in the dairy industry-today and tomorrow. Milk can become highly relevant to each of the key need-states identified in the segmentation study and can gain share of consumption from competitive beverages," says DMI CEO Tom Gallagher.

"The industry, however, must deliver meaningful innovation to close the relevance gap for milk through specific product benefits, more exciting packaging, greater availability and real branding."

Opportunities in Value-added Milk

100% MilkProducts made with 100% milk, with specific value-added benefits:

- flavors

- lactose reduced

- added nutrients

- single-serve bottles

Products with milk as a key ingredient, but less than 100% milk:

- lattes

- nutritional drinks

- smoothies

- meal replacements

Key Attributes Cited by Consumers

Replenish- flavors

- portable

- cold

- pure

- healthy

- craving

- somewhat healthy

- good taste

- sophisticated

- rich

- treat

- smooth

- unstressed

- active lifestyle

- knowledgeable

- functional benefit

- performance

- in control

- portability

- ingredients

- replenish