Indeed, many cultured dairy products are growing at rates never experienced before. According to a hot-off-the-presses report from Packaged Facts entitled The U.S. Market for Cultured Dairy Products, the current 2004 $9.4 billion market, which includes all retail and foodservice venues, was up 8.1% from $8.7 billion in 2003. But more exciting still is the news that Packaged Facts projects that sales will grow to $15.5 billion in 2009, reflecting a compound annual growth rate of 10.6% during the 2004-2009 forecast period.

So what is a "cultured dairy product?" According to this report, cultured dairy products include buttermilk, cottage cheese, cream cheese, dairy dips, drinkable yogurts, which are also often called yogurt smoothies, kefir, probiotic shots, sour cream, yogurt cups and yogurt tubes. And, other than buttermilk, all of these categories are expected to experience an increase in sales. (Details on ordering this comprehensive 200-plus page report can be found at the end of this exclusive Dairy Foods feature story.)

Probiotic bacteria boom

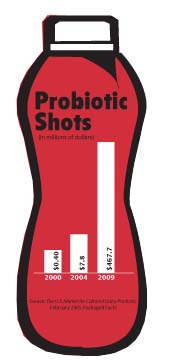

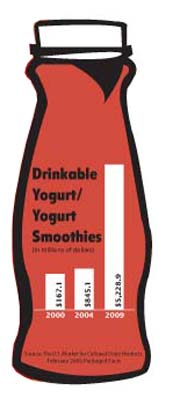

"The refrigerated cultured dairy products category is poised for unprecedented growth as a result of a variety of marketplace factors, primarily dairy's healthful halo," says Packaged Facts Acquisition Editor Don Montuori. "Better-for-you and demographic-focused formulations include the addition of probiotic bacteria, fiber, vitamins, minerals and other healthful ingredients, as well as bold and sometimes quite ethnic flavors."In addition, probiotics are a leading formulation trend for 2005," Montuori continues. "Europe and Japan have made so-called ‘intestinal health' drinks packaged in tiny little bottles into a multi-million dollar market. Americans have been slow to embrace these beverages, but the success of drinkable yogurts and yogurt smoothies is paving the way for probiotic shots. Furthermore, probiotics are driving the development of other cultured dairy products, too, not just probiotic shots."

Packaged Facts estimates that the non-drinkable yogurt segment, i.e., single-serve cups, multi-pack cups and tubes reached $4.7 billion in 2004, accounting for the largest share of cultured dairy product sales. Within the non-drinkable yogurt category, single yogurt cups were the leader, but growth of multi-packs has been outpacing single cups in recent years.

"It's all about convenience and availability," says Montuori.

And, of course, as with all food categories, portability is key. "Drinkable yogurts and yogurt-based smoothies failed in the past because consumers did not place so much importance on portability. In today's marketplace, if you can't consume it on-the-run, chances of success go down significantly," says Montuori. "When it comes to value, consumers get it. They are very willing to spend a buck or two on a 12-oz yogurt drink that can serve as breakfast or even a light lunch."

Montuori is right on. Packaged Facts' analysts project that out of all cultured dairy products, fluid products will experience the strongest compound annual growth rate (37.6%) during the 2004-2009 period. But hold onto your seats, sales of probiotic shots are expected to grow at a compound annual growth rate of 97.4% during the forecast period. Yes, that's right, probiotic shots.

For example, Dannon is so confident that DanActive will make a difference in a consumer's life once he or she uses it as directed, that the company has extended what it calls the DanActive Challenge. Instructions tell consumers to consume one bottle per day, for up to one month, and if DanActive does not work, consumers get their money back. What does Dannon mean by "it works?" Well, this is somewhat arbitrary, as Dannon explains that "it works" means something unique to everyone. But, in general, working means it helps the body resist fatigue, reduce stress and avoid intestinal imbalances. It helps the body build immunity so it functions effectively and efficiently.

Dannon uses a Website to explain that DanActive is a great-tasting probiotic cultured dairy drink that is clinically proven to help naturally strengthen the body's defense system. Each bottle contains exclusive Lactobacillus casei Defensis™ cultures, which work in the digestive tract where about 70% of the human body's immune system is located.

Dannon is dedicated to educating consumers around the world about probiotics. And, other cultured dairy marketers are sure to benefit. For example, in conjunction with the 2004 Third International Convention on Probiotics, an unprecedented two-day gathering of more than 110 physicians, researchers and experts from 30 countries sponsored by Danone Vitapole in Paris, France, Dannon launched The Dannon Probiotics Center (www.dannonprobioticscenter.com). This comprehensive online resource is designed to bring the latest news and developments about probiotics to consumers, healthcare professionals and the media.

"According to a survey we conducted earlier this year (2004), nearly a third of Americans said they were very concerned about the strength of their immune system, yet 65% did not know the beneficial impact probiotics can have on immunity," says Miguel Freitas, medical marketing manager at Dannon. "Dannon created the Probiotics Center to be the ultimate destination for information about probiotics, including serving as a portal for the latest scientific studies about the important role probiotics can play in promoting good health."

In addition to creating The Probiotics Center, Dannon is assembling a scientific advisory board, comprised of leading medical experts and is funding new research in the probiotics arena.

"Dannon might be committed to educating consumers about probiotics, but in the United States, Stonyfield Farm (Londonderry, N.H.), of which 85% is owned by Dannon's parent company in Paris, is likely the most innovative in terms of using and marketing probiotic cultures," says Montuori. "With these two players working together, the probiotics dairy business is destined to grow in the United States." Dairy Foods magazine thinks it is just a matter of time before Stonyfield introduces its very own probiotic shot.

Probiotics are driving the development of other cultured dairy products, too, not just probiotic shots. For example, Brookshire Grocery Co./SouthWest Foods now includes extra cultures in its Goldenbrook Farms line of yogurts. Six-ounce cups of low-fat and light yogurt, as well as the 32-ounce multi-serve plain variety, all contain five lactic acid bacteria. In addition to the two standard yogurt cultures-Streptococcus thermophilus and Lactobacillus bulgaricus-Goldenbrook Farms yogurt contains Lactobacillus acidophilus, Bifidobacteria bifidus and Lactococcus paracasei ssp. casei.

According to NBC's Today Food Editor Phil Lempert, "Manufacturers believe labeling is key to creating a ‘bacterial bonanza' for [cultured dairy] products. As the term probiotic becomes more common, [manufacturers] think consumers will seek out items that clearly indicate possible health benefits, probiotic claims and/or the Live and Active Cultures seal." Yes, Phil, this is exactly what we are hoping for.

Carbs raise calorie consciousness

Educating consumers about the benefits of consuming probiotics in dairy foods is critical to the success of these products. However, what's also important is that manufacturers offer consumers products that provide solutions to overcoming the current obesity epidemic. That is, lowering calories and increasing nutrient density.Indeed, all that talk about good carbs and bad carbs that filled pages and pages of consumer media in 2004 has made consumers more aware of carbohydrates that are "empty," in other words, carbohydrates that provide little more than just calories.

In the 19th Annual Report on Eating Patterns in America from the NPD Group, Port Washington, N.Y., statistics show that Americans are becoming more calorie conscious. In fact, 27% say they are conscious of the calories in their meals-the highest number since 1999. The data also shows that Americans are becoming concerned about sugar in their diet. In fact, 22% of Americans are concerned about sugar, up from 20% in 2003.

Less sugar, low sugar and no-sugar-added are phrases that have been popping up on many of the new cultured dairy products targeting carbohydrate-conscious consumers. For example, HP Hood LLC, Chelsea, Mass., flags the fact that its Carb Countdown™ reduced-sugar low-fat yogurt contains 80% less sugar than regular low-fat yogurt.

Omaha-based Roberts Dairy LLC, recently introduced a line of low-calorie, fat-free yogurts. Each serving is just 70 calories and has 8g of protein and 30% of the recommended daily calcium.

Many of the lower-calorie and lower-carbohydrate cultured dairy products that debuted this past year use non-nutritive sweeteners. For consumers who want to reduce calorie and sugar intake but without consuming non-nutritive sweeteners classified as "artificial," Stonyfield Farm now offers all-natural Light Smoothies. The company is the first dairy to achieve reduced sugar and calories without the use of aspartame or sucralose. The product relies on the sweetness of erythritol, which is an all-natural sugar alcohol that has a zero glycemic index. Therefore, it has no effect on blood glucose or insulin levels.

"When we first introduced our organic yogurt Smoothies in 2002, consumers just went wild for the great taste," says Gary Hirshberg, pres. and CEO of Stonyfield. "Our new Light Smoothies are perfect for consumers who want not only taste and convenience, but also want to include yogurt smoothies in a balanced diet. With great taste and all-natural ingredients, there's no need to compromise."

Like all Stonyfield yogurts, Light Smoothies contain six live active cultures, more than any other nationally available brand, including the exclusive Lactobacillus reuteri, which helps boost the body's immune system.

Cottage cheese revival

After a decade or so of the industry trying to rid cottage cheese of its "diet food" image, dieting trends of the past few years have put cottage cheese back in the dieting spotlight. Naturally high in protein, cottage cheese has become a favorite for many followers of Atkins® and The South Beach Diet™ plans.Some marketers actively promote the carb-friendly nature of cottage cheese. For example, Wells' Dairy Inc., Le Mars, Iowa, markets Blue Bunny® Carb Freedom® Cottage Cheese. Available in 24-oz containers, a single serving has 3g net carbohydrates and 13g protein, which is similar to most cottage cheese products in the marketplace.

Other marketers are appealing to consumers by adding flavor to cottage cheese. For example, HP Hood now offers a line of flavored low-fat cottage cheeses in 16-oz tubs. Varieties are Black Pepper & Herbs, Chive & Toasted Onion, Peaches, Pineapple & Cherry and Strawberries.

A company long known for having a strong cottage cheese following, Anderson Erickson Dairy, Des Moines, Iowa, now offers Mr. E.'s Garden Vegetable Cottage Cheese. Named after the company's CEO Jim Erickson, the new cottage cheese variety is loaded with pieces of carrots, sun-dried tomatoes, celery, green peppers, onion and garlic. The company says it's great alone, or with a baked potato, pasta or salad.

Anderson Erickson's cottage cheese history is worth mentioning at this time, particularly since it recently survived a huge obstacle: A change in package and process that threatened its signature "old fashioned" flavor and mouthfeel.

A little more than a year and half ago, the company was still making its cottage cheese the old fashioned way, which meant hand packing containers. While most dairies had quit hand packing cottage cheese by the 1970s, Anderson Erickson continued the practice until its packaging supplier stopped making the required waxed paper cartons. Such cartons were deemed necessary because more modern plastic cups did not lend themselves well to hand-packing operations.

What was so special about hand packing is that this labor-intensive process allowed the cream to settle on the bottom of the carton, leaving moist whole curds on top. The pressure required for machine packing has the potential to damage the curds and allow cream to be absorbed throughout the product. However, determined not to disappoint customers, the scientists and engineers at Anderson Erickson managed to identify a more automated process that allows for plastic cartons but still delivers that special old-fashioned cottage cheese.

Other cultured categories

"One industry trend-a slowing of the low-carb craze and a return to whole grains-will have consumers once again seeking out bagels and bialys," says Montuori. This means a renewed interest in cream cheese as a topper.And when it comes to dairy dips, which for all purposes are those dips sold in the dairy or refrigerated produce case, their popularity continues to grow thanks to more healthful, as well as flavorful creations. "Traditional French onion is still popular, but what gets consumers to splurge on dip is new twists on old favorites," Montuori says. "Learning from the cream cheese business, where it appears adding any flavor is fair game, dip manufacturers are adding some kick. For example, Anderson Erickson now markets Southwestern French Onion Dip, which relies on chipotle peppers to give it a little extra kick without being a hot, spicy dip."

Many "dairy dips," as defined in the Packaged Facts report, and also as classified by most scanner-data providers, are based on sour cream, but some are vegetable oil-based. When one looks at these true dairy-based dips, a formerly regional player is making great strides in gaining national notoriety. The brand: Heluva Good®, the marketer: HP Hood.

It took more than three years, but regional dairy HP Hood finally acquired two other regional players-Crowley Foods and Kemps (formerly Marigold Foods Inc.)-in May 2004. Hood, Crowley and Kemps continue to manufacture and distribute their branded and licensed products as they did before the acquisition. The Kemps acquisition brings many strong cultured dairy products to HP Hood's portfolio including Kemps cottage cheese, sour cream, yogurt and Yo-J. The former is the country's oldest yogurt and juice blended beverage. With the Crowley acquisition comes Heluva Good.

Similar to Anderson Erickson's cottage cheese fan club, consumers who grew up on Heluva Good dips tend to seek the brand out. One way Heluva Good keeps its current customer base's taste buds enticed in through its limited edition flavor program. The company rotates new flavors in and out every four months. Highly successful limited edition flavors sometimes become part of the regular product line-up, whereas others return after a few other flavors rotate in and out. This past holiday season, Heluva Good debuted Green Chili Pepper Dip, which proved to quickly be another flavor hit.

In conclusion, the Packaged Facts report points out that cultured dairy products are enjoyed around the world, and consumed in much greater levels than in the United States. This presents a lot of room for growth, particularly as the world becomes a smaller place to live. In addition, the continuing increase in the Hispanic population is a major factor in growth of certain cultured products, particularly drinkable yogurts, yogurt smoothies and sour cream. n

For more information on purchasing a copy of the February 2005 Packaged Facts report The U.S. Market for Cultured Dairy Products, visit www.marketresearch.com, or call 800/298-5294.

Sidebar: Opportunities Beyond Standards

In December, FDA issued a temporary permit to Wells' Dairy Inc., Le Mars, Iowa, to test market cottage cheese that deviates from the U.S. standard of identity for cottage cheese (21 CFR 133.128). Why is the cottage cheese out of standard? It is made using fluid ultrafiltered (UF) skim milk. Fluid UF skim milk is obtained by subjecting skim milk to a physical separation process called ultrafiltration. The process includes passing milk through a membrane with very small pores that remove most, but not all of the lactose, minerals, water-soluble vitamins and water present in skim milk.The casein-to-whey protein ratio of skim milk is not altered during the ultrafiltration process. The moisture content of fluid UF skim milk is about 80%, whereas regular skim milk is about 91% water. To make cottage cheese, fluid UF skim milk is added to skim milk at a level needed to increase the total solids of the cheese milk by 5% to 25%.

The fluid UF skim milk is being declared in the ingredient statement of the finished cottage cheese as "ultrafiltered skim milk." As stated in the Federal Register (Dec. 9, 2004, Vol. 69, No. 236, pp. 71418-71419), Wells' test product meets all the requirements of standardized cottage cheese with the exception of the use of fluid UF skim milk. The purpose of the temporary permit is to allow the applicant to measure consumer acceptance of the product, identify mass production problems and assess commercial feasibility.