Coca-Cola Enterprises (CCE), which was founded by Coca-Cola corporate and is the largest Coca-Cola® bottler in the world, has a distribution deal with Bravo! Foods International Corp., North Palm Beach, Fla. That's how Coca-Cola currently is in the milk business in the United States.

Coca-Cola recognizes the fact that different consumers have different beverage needs, and even more important, that these needs change over time. To stay current with consumers' needs, it is necessary to innovate, a term that takes on many meanings for Coca-Cola.

"Without innovation, there can be no growth," says Neville Isdell, chairman and CEO of Coca-Cola.

For Coca-Cola, innovation that adds value to milk is more than formulating and marketing milk beverages. It includes distribution partnerships with other industry leaders. CCE's exclusive 10-year distribution agreement with Bravo! Foods includes the opportunity for CCE to become a minority shareholder of Bravo! Foods. Thus, without ever running a pasteurizer and homogenizer, Coca-Cola will be a milk marketer.

Bravo! Foods CEO Roy Warren says, "The single-serve, flavored-milk industry segment has grown considerably over the last several years despite the inherent constraints of traditional chilled dairy distribution systems. Slammers® are packaged with shelf-stable technology that allows for long shelflife and ambient storage. This advancement allows the Slammers brand to become a serious competitor in the multi-billion-dollar ‘better-for-you' drink business, which is now the fastest-growing segment of the beverage industry."

CCE began distributing Bravo! Foods' Slammers in the fourth quarter of 2005 to convenience stores, schools and universities, vending accounts and small independent stores nationwide. "Bravo! has a strong line-up of shelf-stable milk products, which we believe will be an excellent addition to our product portfolio," says John Alm, president and CEO of CCE. "Our new partnership creates the opportunity to combine Bravo's unique brands with the strength of our distribution and selling system."What the partnership also does is add value to milk for all players in the supply chain.

Coca-Cola and Pepsi both understand that today's consumers won't settle for a one-size-satisfies-all beverage.

"For more than half its history, Coca-Cola sold exactly one product in exactly one package," Isdell says. Today, the company markets nearly 400 brands in more than 200 countries, in an extensive range of package materials, shapes and sizes. This variety adds value to the beverage business.

Isdell says that one of his favorite definitions of value has been summed up by Coca-Cola board member Warren Buffet, chairman and CEO of Omaha, Neb.-based Berkshire Hathaway Inc., "Price is what you pay.Value is what you get."

According to Isdell, "Coca-Cola offers a beverage for every occasion and every need or state. As long as consumers want variety-as long as their preferences keep changing-we're going to give it to them."

What do consumers want?

Dairy Foods teamed up with BuzzBack Market Research (www.buzzback.com), New York, a leader in providing fullservice online market research solutions, to ask consumers about their expectations and perceptions regarding consumption of beverages, in particular milk. Over a 10-day period in early October, 990 adults ages 18-70 years old responded (51% female, 49% male).Three different occasions for beverage consumption were explored in the beginning of the questionnaire to understand typical considerations when a consumer chooses a beverage when eating a meal, eating a snack and after exercising. "As one might expect, ‘tastes good'was the leading factor by a relatively high margin for meal or snack occasions," says Carol Fitzgerald, president and co-founder, BuzzBack. "In terms of after-exercise consumption, there are three top factors: It is a thirst quencher; it is hydrating; and it is refreshing. Health considerations were also more likely to play a role in post-exercise beverage consumption than in snack-time or meal-time consumption."

Of the 990 respondents, almost 11% currently did not drink milk and were eliminated from the rest of the survey, which was answered by 883 consumers.

"The top reasons for drinking milk are based on health benefits and/or taste," Fitzgerald continues. "With regard to health, over half of respondents say they drink milk for the calcium and vitamin D, and because it is healthy and nutritious. Likewise, over half of the respondents rate calcium, vitamin D, protein, vitamin A, fat content and potassium as being important or very important nutritional aspects of milk. Concerning taste, over half of respondents say milk satisfies them and it simply tastes good."

This is information that all types of beverage marketers likely know, which is why so many non-dairy companies are now selling milk-for its taste, nutrition and satisfaction. The dairy industry no longer owns the milk franchise, but it is not too late to capitalize on the value-added milk concept.

Back to the survey, when choosing a particular kind or brand of milk, more than 40% of respondents deem variety and availability very important factors. And, when it comes to the new generation of single-serve milk products in the marketplace, half of the respondents said that it was either very important or important that the milk come in a resealable plastic bottle or container. When asked to describe how they drink milk, 22% of respondents checked flavored, in readyto-drink bottles as one of many ways.

This is noteworthy as flavored, single-serve bottles of milk were largely unavailable 10 years ago and today still have limited distribution. The fact that more than one-fifth of consumers drink milk this way is exciting (and promising) news to themilk industry.

What does it all mean?

Coca-Cola's Isdell has more to say about consumers and how the retailing environment dictates product offerings. "As retailers look for ways to distinguish themselves in the eyes of consumers, they need good, strong brands to help bring shoppers through the doors and improve the shopping experience," Isdell says.The fact is all types of consumer research show that consumers are increasingly looking for healthy, functional products that can assist them with achieving a specific lifestyle or physical or mental objective. And when the beverage is "packaged" as such, historical evidence indicates that consumers are willing to pay a premium for added benefits . . . for value.

"Consumers today are becoming increasingly aware of the effects that food and drink have on their bodies and minds," says Jose Cubillos, v.p., brand development, Dairy Management Inc.™

"And all the research shows that consumers want convenient, healthy and tasty products, which is why all types of beverage manufacturers are turning to milk for their formulating needs.

"PepsiCo's goal of getting consumers to reach for a Quaker Milk Chillers rather than a cookie or a candy bar when craving a snack is something that U.S. dairy processors really need to factor in to their product development efforts," says Cubillos.

Indeed, the traditional definition of "snacks" no longer applies. A new research report from the International Dairy•Deli•Bakery Association™ (IDDBA), Madison, Wis., titled Snacking Trends:A World of Opportunity, points out that retailers, as well as many food and beverage manufacturers, have not caught up with consumers' expanded view of snacks and snacking. This is leading to lost business opportunities.

The view of snacks as consisting of just cookies, crackers, chips and similar items has been rendered obsolete by an evolution in consumer behavior and lifestyle dynamics. Only one in five Americans defines snacks as being just those products traditionally sold as snack foods.This leaves a vast majority of consumers who have adopted a greatly expanded view of snacks-one that could include virtually any type of food or beverage.

Rather than thinking of snacks as a type of product, we should think of snacking as a type of eating occasion, with availability and variety of product influencing how consumers snack. Availability has become an issue for many milk marketers, but it is one that can be readily overcome with an investment in innovation.

"Milk processors must understand that future growth will not come from sales of gallons of whole, low-fat and nonfat white milk sold through traditional supermarkets," says Greg Miller, executive v.p., innovation, DMI. "This is because today's consumers are presented with an endless array of food shopping choices, and many are increasingly shunning the neighborhood supermarket and going to supercenters such as Wal-Mart®, club stores like Costco® or other discounters such as dollar stores. Some shop the specialty route, and frequent the likes of Whole Foods®,Wild Oats® and Trader Joe's®."

These varied retail venues often have product and package requirements. Club stores want single-serve packages, but they must be sold in bulk multi-packs, and shelf stability is helpful, as such venues have limited refrigerated space.Value-added half-gallons of milk must be sold in multi-packs, too, which can range from being shrink wrapped to boxed.

Specialty foods stores stock milk products that offer customers value in terms of formulation.This includes low-lactose, no-sugar-added and nutrient fortified. Dollar stores require the obvious: a product for a buck. And with c-stores, it is all about convenience.

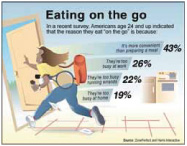

"Consumers are living on-the go lifestyles," continues Miller, "and individually bottled beverages formulated for varied individuals' needs are the way the industry is going. If dairy processors do not offer milk using this approach, others will."

The fact is, high quality and individualization are driving forces in today's highly competitive retail and foodservice consumer goods marketplace. Consumers are attracted to foods and beverages that meet their needs-both nutritionally and physically. Milk's healthful halo is the starting point for innovative product development in these areas.