Jerry Dryer

Market Analyst

jdryer@jdgconsulting.com

Market Analyst

jdryer@jdgconsulting.com

The beverage milk business has come a long way, but sales data tell us there is a lot more to do.

Almost 10 years ago, I wrote a column forDairy Foodsthat asked the question: Can milk be niched? Food marketing experts love to talk about the virtues of niche marketing and valued-added, specialty products. But the question remains: Is niche marketing appropriate for the fluid milk business?

I answered my own question, and still do, with a resounding, YES! The earlier column appeared back in the days when pioneers like Scottie Mayfield and Howard Dean had just introduced milk in a fanciful, plastic, re-closeable bottle. At about the same time, PepsiCo and Starbucks had teamed up to launch Frappuccino. That was when "fluid milk" was a commodity business, totally volume driven, albeit a declining volume. The marketplace had changed dramatically while milk sat on its hands.

- Most milk was consumed at home, but consumers were spending more time and money in restaurants.

- A large percent of milk had been consumed at breakfast, but more people were skipping breakfast.

- Kids were the principle consumer, but the population was turning gray.

- Caucasians were the big consumers, but they were a shrinking percentage of the population.

- Milk was facing a host of new competitors including bottled water, juice drinks, tea, sports drinks and all matter of blends.

- Milk contained fat and fat was worse than most four-letter words.

Citing the initial success of the Milk Chug, I predicted that the decade ahead would see increased new-product development, increased technological development and increased image-building in the dairy beverage business.

Ever the optimist, I think I was at least half correct. Equipment suppliers, Dairy Management Inc, beverage companies like PepsiCo and Coca-Cola, and a few dairy processors have created dozens of new products by using a host of new and modified technologies. The image-building component is a work-in-process.

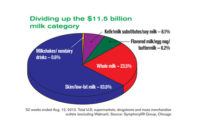

Total beverage milk sales, unfortunately, are still declining.

The one big challenge I didn't mention in my earlier column was price, or more appropriately, the pricing of milk being sold to the marketers of dairy beverages. Yes, milk is a lot more costly than water or carbonated water.

Far too many of the "new" beverages use nonfat dry milk or some other source of milk solids to avoid the whip lash of Class I milk prices.

With a better cost structure, we would see a lot more products like flavored and fortified milks of Bravo! Foods. We would see a lot more marketing and promotion effort put behind the stable of products carrying the Nestle's and Hershey's labels. We'd see a lot more research and development effort in the laboratories of PepsiCo and Coca-Cola.

Last year, PepsiCo sold more than $150 million worth of those little glass bottles of Frappuccino.

We can't reverse the God-given demographic changes that dictate a continuing decline in the sale of gallon jugs of milk. We can do something about the man-made regulatory system that stymies innovations and sales.

There are dozens of niches waiting to be filled by dairy-based beverages. Let's figure out how to make it happen. We are more than halfway there. We have the processing technology. We have the package. We have the products. All we need is a pricing system that works for all concerned.