Sponsorships:

Sponsored by Huhtamaki

Co-Sponsored by DMI, Ecolab and Big D

WHITE PLAINS, N.Y.-An armory here now occupies the site where, on July 11, 1776, America’s Declaration of Independence was read publicly in New York State for the first time. White Plains is also home to the corporate headquarters of the oldest yogurt company in the United States-The Dannon Company. In Dannon’s two-year-old offices a group of food industry veterans from the U.S. and around the world has been hard at work this year plotting a revolution in the North American yogurt market.

During the war of independence, George Washington established a headquarters in White Plains from which he and his troops waged a pivotal battle. The Dannon team is led by Juan Carlos Dalto, a 41-year-old Argentinean native who became Dannon’s president and CEO just a bit more than two years ago. What Dalto and Dannon’s other generals are gearing up for is nothing short of a battle for the hearts, minds and stomachs of the American consumer.

Their mission is made more remarkable by the fact that to many in the U.S. dairy industry, the yogurt war has already been won. In April of this year,Dairy Foods’ annual Cultured Product Trends article declared that yogurt is “now part of American culture.”

Every time new retail data is released there is something good to be said about yogurt. Compared to the other dairy segments-indeed to most other U.S. food categories-yogurt is a model of success.

Despite this, the people at Dannon and its parent company, Groupe Danone are convinced that the U.S. market hasn’t seen anything yet. They see North America as an emerging or underdeveloped market with comparatively low per-capita yogurt consumption-about 7.5 lbs annually compared to more than 18 lbs in the UK, and 50 lbs in France. They are certain that they can boost that number significantly, maybe double it, within a few years. The plan is to offer “high health” (read probiotic, functional yogurts) products that have been developed and successfully introduced in other parts of the world.

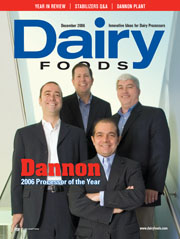

Dannon’s executive team includes, from left, CEO Juan Carlos Dalto; V.P. of Sales, Jim Murphy; Senior V.P. of Marketing, Andreas Ostermayr; and V.P. of Manufacturing, Tim Reagan.

“One year ago the answer wouldn’t have been that clear for us,” says Dalto, who has been with Danone since 1997, and served stints with other international corporations like Kraft and Pillsbury. “But today-after the experience with Activia, a brand that was only introduced in January and is going to do more than $100 million this year-today we feel much more confident that this is the right step.”

The success of Activia-a product that fits firmly into the category of a functional food-has been phenomenal, by anyone’s accounting. It might be the surprise story of the year in the dairy industry, certainly in yogurt. But for Dalto, and other Dannon executives some of whom have come from successful operations in the UK, Germany and France, it may not be such a surprise.

“For a company like ours, this is not new,” Dalto notes. “We are less and less afraid, because we have tried this solution in many different latitudes, and it has worked.”

Dannon planted the seeds of the U.S. yogurt market more than 60 years ago. Through ownership changes and shifting trends, it has remained a market giant and a pioneer. For its decades of accomplishments, and for the ambitious effort it has only recently undertaken, The Dannon Company has been selected asDairy Foods’ Processor of the Year. It is only the second yogurt specialist to be so honored, the first having been its sister company Stonyfield Farm, in 2003.

The U.S. launch of Activia, has been even more successful than expected. The probiotic yogurt is sold in more than 25 countries worldwide.

History here and abroad

Groupe Danone’s global headquarters is located in a beautiful Baroque building on the Boulevard Haussmann near the Paris Opera House. It is an appropriately elegant setting for a truly unique corporation.Danone is one of the top 20 global food companies, and describes itself as the largest fresh dairy company in the world. It was one of the earliest companies to publicly reflect on the responsibilities of corporate citizenship. Danone employees are often reminded of a 1972 speech in which its top executive at the time, Antoine Riboud said that “a company’s responsibility does not end at the office door or the factory gate, since its action affects the community as a whole.”

The sentiments expressed in “the Marseilles Speech” are carried over into a parallel corporate mission to achieve business success and social progress. Danone continually intertwines the two, as it focuses primarily on nutrient rich and essential foods in three groups-fresh dairy, beverages and biscuits. While it has specific values concerning diversity, humanity, and protecting the environment, its number one social cause is worldwide child malnutrition.

In the dairy division, the basic line of Dannon branded products accounts for about 40% of worldwide sales, but Danone says that much of its success around the world in dairy is also attributable to five “blockbuster brands” that include Activia (it’s sold in more than 25 countries), the probiotic dairy shot Actimel (DanActive in the U.S.) available in more than 30 world markets, Danonino, a fresh cheese for young children, the dairy dessert Danette, and a range of light yogurt products marketed under different names.

At least two of those products are what the company calls high health products. Danone has been very successful with these, and in various world markets it is optimistically introducing new yogurts designed to lower cholesterol, regulate digestion, strengthen the immune system, help regulate blood sugar, help control hunger cravings, and even improve the vitality of skin and hair.

In the United States, Dannon’s history goes back to 1942 and the launch of Danone Milk Products in the Bronx, N.Y.

In the 1940s, few Americans had ever tried yogurt, then a staple in many European countries. Initial distribution was limited to the New York City area. Manufacturing peaked at 648 servings of plain yogurt a day, and the product was sold in returnable half-pint glass jars.

In 1947, a breakthrough came when Dannon introduced yogurt with strawberry fruit on the bottom. Other fruit flavors were soon added and the line became America’s favorite yogurt. A year later Carasso sold his interest in the company to a partner and in 1959 the company was sold to Beatrice Foods.

While Beatrice helped Dannon become a national brand by the late 1970s, Daniel Carasso was back in Europe growing Danone. In 1973, the French firm BSN merged with Danone. In 1981, BSN-which was becoming one of the world’s largest food manufacturers-bought The Dannon Company from Beatrice Foods.

By then yogurt was not quite so alien to American consumers, and new types of products had been developed to appeal to dieters, mothers and children, and those who were looking for more excitement and convenience.

In the past 20 years, Dannon has introduced many successful product lines including Dannon Light & Fit, Blended, Sprinkl’ins, Danimals, and la Crème. As a generation of Americans has grown up with (and grown to love) yogurt, Dannon, General Mills, Stonyfield Farm, and other smaller competitors, have enjoyed a yogurt market that has grown steadily.

In 1993, Dannon relocated to Tarrytown, N.Y., and in 2004 moved to its current offices, back in White Plains. It now operates three plants and three distribution facilities, and employs about 1,200 people.

The next big push will be for the probiotic shot DanActive, which has been sold in test markets since 2002.

The per-capita challenge

Like most consumer goods companies, Dannon utilizes a toll-free consumer telephone line to answer questions and accept comments. A recent recording of one of those phone calls has been widely circulated among Dannon employees.A woman speaking with an operator begins by saying that she had never eaten yogurt in her life until she tried Activia to relieve her chronic irregularity. As she describes her experience she pauses to keep from breaking down into tears.

“Since I was a little girl, I’ve never been able to go to the bathroom regularly,” she tells the operator. “This product has absolutely changed my life.”

This kind of experience with Activia, combined with a serious marketing push from Dannon, has made it a runaway success with repeat buys and brand loyalty numbers that the company has simply never seen before, says Sr. V.P. of Marketing, Andreas Ostermayr.

“Two of the key performance indicators we analyze with every new product launch are frequency of purchase and the average volume of each purchase . . . and Activia is leading the way with frequency and weight of purchase,” explains Ostermayr.

Dannon spent about $31 million to advertise Activia in the first half of 2006. “This has been key to the product’s success,” says Ostermayr.

From outside Dannon’s circle, there are others who say the company may have what it takes to help get Americans to eat even more yogurt. The company’s current opportunities, however, might have as much to do with marketing muscle and hard work as they do with the market’s readiness for functional foods, says John McMillin, a food industry analyst with the Prudential Equity Group in New York. McMillin says he would like to believe that consumers are buying Activia for its functional benefit, but he suspects that it might just be that they like the 4-oz size and the flavor.

“It’s true that Danone is playing health and wellness 301 or 401 with things like this, where most U.S. companies are playing health and wellness 101 with weight reduction,” says McMillin. “But the beauty of Activia is that the folks at Dannon U.S. got great distribution of that product. It was kind of everywhere you walked, even in Wal-Mart.”

If in fact consumer acceptance of functional foods has hadsomethingto do with Activia’s success, McMillin sees no reason why Dannon’s per-capita quest should be considered far-fetched.

“It’s important to understand how Danone and Dannon do things,” he says. “They often get ideas from Europe and take those around the world. Maybe in the past there was a belief that some of these things would not work in the U.S. With the success of Activia, now they see that it can.”

Before Activia, only DanActive had been seen as a legitimate attempt to introduce American consumers to functional yogurt. It was first test marketed in 2002 and has achieved consistent double digit growth in the few markets where it has been rolled out, but it doesn’t compare to the success of the launch of Activia, which went straight to national availability.

Dannon is ready to focus on DanActive again, with a complete national roll out in 2007. It is encouraged not only by the success of Activia in the U.S., but also by Actimel’s worldwide track record.

Dannon, with help from Danone, is better equipped than anyone to bring functional yogurt to U.S. consumers, according to McMillin.

“The real question is: will (high health) sell in the U.S.? Activia suggests that it might,” he says.

Dalto with former President Bill Clinton at an event promoting the Alliance for a Healthier Generation.

Good citizenship

When Stonyfield Farm was selected asDairy Foods’ Processor of the Year in 2003, the New Hampshire-based organic yogurt maker was less than two years removed from a deal that made Danone the majority partner in Stonyfield.A question still lingered at the time as to whether the idealistic corporate culture Stonyfield had created could survive a marriage with one of the world’s largest food corporations. The answer, according to Stonyfield CEO Gary Hirshberg, was an emphatic yes. Hirshberg said his outlook had everything to do with the kind of company Danone is-a company that shared much of the same principals as Stonyfield’s.

Danone’s website features a section on sustainable development. As a food company with a large bottled water component, Danone is most interested in health and nutrition and the protection of water resources. Other key themes concern people, childhood, and the broader issues of environment. In 2001, Danone launched the Danone Way, a program that enables separate business units to link business strategy and sustainability more effectively. Today the program is extended to 90% of business units.

For instance, Danone recently partnered with the Global Alliance for Improved Nutrition to form Grameen Danone Foods, a unique initiative to bring daily healthy nutrition to low income, nutritionally deprived populations in Bangladesh. Its initial focus will be to introduce an easily affordable dairy product specifically developed to help meet the nutritional needs of children. Last month Grameen Danone cut the ribbon on its first production facility. The long-term objective includes the development of 50 plants designed to operate locally.

This is among dozens, if not hundreds, of individual initiatives that Danone is involved with around the globe.

In the states, The Dannon Company has a history of working on initiatives to fight hunger and improve nutrition. It recently awarded the first Dannon Next Generation Nutrition Grants of $25,000 to $30,000 to selected community organizations to improve children’s nutrition education.

In 2005, Dannon eliminated all the plastic overcaps from its 6-oz. yogurt cups and to celebrate it donated $100,000 to Toys for Tots. Staff at Dannon’s Texas facility participated in several relief programs for the victims of the 2005 hurricanes.

The Dannon Company is one of five U.S. food companies which along with the William J. Clinton Foundation and the American Heart Association, have formed the Alliance for a Healthier Generation. The idea is to establish first-ever voluntary guidelines for snacks and side items sold in schools that will provide healthier food choices for the nation’s children.

Building the team

Dalto came to Dannon in 2004, replacing Thomas Kunz who is now part of Danone’s executive board in Paris. Before taking the reins in the United States, Dalto served as marketing v.p. at Danone Argentina, and CEO at operations in Portugal and Italy.Other executive board members who have joined the Dannon team since 2003 include Ostermayr, who came from Danone Germany in Dec. 2004, Francois Blanckaert, v.p. of purchasing who came from France in 2003, and Tim Reagan, v.p. of manufacturing, who joined in 2006 from Kraft Foods.

The success of Activia has a neat chronological relationship to these personnel changes. Yet Danone executives in Paris disagree with the notion that having an internationally-experienced executive team in White Plains was necessary for the development of a successful growth strategy.

“Juan Carlos has terrific international experience and strong relationships throughout Danone worldwide,” says Bernard Hours, gen. dir. of fresh dairy products for Groupe Danone worldwide. “He understands what his team needs to successfully implement the high health strategy.”

Hours points out that the front offices at the Dannon Company are in fact populated by a mix of homegrown talent and executives from around the world. He does however permit that having a proper unit-wide attitude has been instrumental.

“At Danone, we foster a culture that strongly encourages collaboration across the globe and the U.S. team continues to take advantage of this strategic advantage and to overcome the risk of the ‘not-invented-here’ syndrome,” he adds.

Dalto himself referred to that same syndrome in a recent interview with theWall Street Journalfor a story recognizing a new breed of American executives. The article credits Dalto and his colleagues with taking Danone’s success with Activia and tailoring it for the U.S. market. In the article, Dalto says while selling the idea of Activia to managers and sales reps, he made reference to the Statue of Liberty as an import that became an American icon.

Some observers might credit Dalto and the current executive team at Dannon with extraordinary foresight. Or, they might reflect on the hard work that has been done for decades in building an American identity for yogurt. They might look at Dannon’s recent success, and just chalk it up to Activia being in the right place at the right time with the right flavors. No matter how you see it, there is no denying that Dannon is on a roll.

“We hope that this year we will grow around 9% in sales,” Dalto says. “That would put us close to $1 billion in sales in 2006. We thought Activia could sell maybe half of what it did, so really, we believe we could have grown even more. We have been limited by our capacity or we could have possibly achieved double-digit growth this year.”

The questions now become whether or not this is sustainable, and will it make Dannon the clear front-runner over its top rival. Dalto downplays the importance of the latter, and says the shelf space will continue to grow for everyone. Yet he sounds at times like a general who is prepared for a crucial battle.

“It’s a competitive market,” Dalto says. “So we’ve invested a good amount of time in sharing with our retail customers the strategies and the opportunities, and what they can expect as we are getting there. And they have partnered with us big time.”

The strategy includes more than just new roll-outs, of course. There are packaging overhauls in the works, more plant capacity on the way, and the company just contracted with a new media agency, and plans to re-focus some of its consumer messages.

How does Prudential’s McMillin see Dannon’s future shaping up?

“The thing that’s going to drive Dannon in the U.S. is the pipeline of new products coming from Europe and the success of Stonyfield,” he says. “Dannon benefits from being part of a global company with research going on around the world. You see the global strength of Danone and that’s who I’d put my money on.”

Timeline:

- 1919

- Danone founded in Spain by Isaac Carasso, who names it for his young son Daniel.

- 1929

- Daniel learns the family business in Spain and establishes Danone France.

- 1942

- The younger Carasso moves to the United States and founds Danone Milk Products in New York. A year later the name is Americanized as the Dannon Milk Co.

- 1947

- Dannon adds fruit to its yogurt, and sales grow dramatically.

- 1959

- With sales increasing, Beatrice Co. buys Dannon.

- 1960

- Beatrice builds a modern plant in Ohio and begins a western expansion that makes Dannon the first coast-to-coast fresh dairy products company in 1979.

- 1970

- Dannon’s memorable “Soviet Georgian” campaign promotes the benefits of eating yogurt.

- 1980

- Groupe Danone buys Dannon back and it becomes the Dannon Company, Inc.

- 1988

- FDA approves the use of Aspartame, and Dannon introduces Dannon Light.

- 1992

- Dannon introduces a yogurt for children, Sprinkl’ins, and two years later adds Danimals.

- 1999

- Drinkable products join the Dannon lineup.

- 2002

- Dannon adds whipped products and introduces Actimel (DanActive) in test markets.

- 2006

- Dannon expands its high health offerings with Activia, which becomes one of the company’s most successful launches ever. The Dannon Company is selected as Dairy Foods magazine’s processor of the year.

Sponsorships

Sponsored by Huhtamaki

Sidebar: Dannon Knows Kids

The Dannon Co., White Plains, N.Y., knows that parents believe in the nutritional value of its cultured dairy products. Yet, to get kids to be consumers, the products must be made especially for their little hands and their finicky taste buds. In the past decade, Dannon has successfully accomplished this, and more. In fact, Dannon has made extra calcium synonymous with the Danimals brand through the addition of the company’s trademarked DoubleCalD, a unique formula that ensures products contain twice the calcium of other leading kids’ yogurts, as well as vitamin D.Dannon is responsible for turning this country’s youngest consumers into a drinkable yogurt generation. Dannon Danimals drinkable low-fat yogurt-the 3.1-oz bottles containing yogurt flavors that even the pickiest eater has a hard time resisting-continues to evolve to meet the needs of parents. Today, no longer limited to four- or eight-packs, the drinkables come in convenient “quick grab” gravity-fed refrigerator packs containing 15 bottles. There’s also a club-size 24-pack, which helps parents keep refrigerators well stocked.

To keep kids consumers, Dannon has the bottle grow with their hands. For older kids, the company sells four-packs of Danimals XL, which are 5.75-oz bottles.

Innovation is ongoing at Dannon, and in January the company will add the power of the world’s most researched probiotic culture,LactobacillusGG (LGG), to Danimals Drinks and Danimals XL varieties. LGG is clinically proven to help kids stay healthy as part of a balanced diet and healthy lifestyle.