We didn't notice it at the time, because U.S. markets were coming off record-high prices that spring, and in our alphabet-soup world, the industry was trying to figure out how to deal with CWT, bST and the rising CPI.

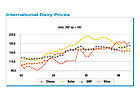

As a result of tightening supplies, world dairy prices have soared since mid-2003.

The tipping point, we can see clearly in retrospect, came in the summer of 2004.

We didn't notice it at the time, because U.S. markets were coming off record-high prices that spring, and in our alphabet-soup world, the industry was trying to figure out how to deal with CWT, bST and the rising CPI.

But outside our borders, a complex stew of its own was brewing. Milk supplies in Europe and Australia were withering under months of heat and drought. EU export subsidies and support prices were ratcheting lower, and 10 new countries from the east joined the union. The U.S. dollar had fallen by close to 40% against the Euro and the New Zealand and Australian dollars in the previous 30 months.

Back home, U.S. nonfat dry milk stocks, which kept a lid on world prices by ballooning to more than a billion lbs. in 2002-03, were in a free-fall. By the middle of 2004, U.S. government NFDM inventories had dropped to 600 million lbs., and were shrinking by 50 million lbs. a month.

And all the while, the global appetite for milk and milk products took off like a teenage boy at an all-you-can-eat buffet.

"World demand for dairy products has been expanding steadily as a result of income and population growth," says Alejandro Reca, executive director of food and agribusiness research for Rabobank International, New York. "Yet, due to production constraints among leading and traditional world dairy producers such as New Zealand, Australia and the European Union, the systematic increase in demand has not been fully matched by supply."

So by the second half of 2004, dairy importers in Mexico, the Philippines, Saudi Arabia and elsewhere found themselves in a sellers' market for the first time in years. Confounded buyers hung up their phones and discovered that lead times on orders had frequently stretched from weeks to months. In turn, prices of most commodities marched to their highest levels in years. Before 2004 had ended, Oceania's cheese and butter was 33% more expensive than the year before, and Europe's skim milk powder and whey prices were up 27% and 23%, respectively.

But an unprecedented thing happened next: demand did not waver. Instead of higher prices rationing supply, as had happened in every previous run-up over the years, consumer demand for dairy around the world remained robust. Instead of building government inventories of milk powder and butter, major world suppliers depleted them.

"Between September 2003 and September 2005, over 1.8 billion lbs. of dairy products were removed from the respective intervention stocks held by the United States and the EU, leaving stocks at historically low levels," says Reca.

Structural shift

Two years later, the fundamentals that took hold in the summer of 2004 have proven to be as persistent as field clover. International prices for milk powder, cheese, butter and whey have retreated slightly from their 2005 highs, but continue to trade in higher ranges than before. Prices for lactose keep on climbing.World SMP stocks have shrunk even further, to the point that they can no longer be counted on to buffer supply shocks. The European Union is tapped out, Oceania's inventory from the past season is already sold and the United States has just one-sixth the holdings it had three years ago. On the cheese side, domestic consumption in the United States and Europe is strong, while demand in the foodservice sector in developing countries is running high.

"We're finding this wasn't just a blip on the screen," says Tom Suber, president of the U.S. Dairy Export Council. "Over the last two years, we've seen a long-forecasted shift take place, one in which the global dairy market tends towards tightness rather than oversupply."

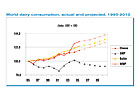

According to the Organisation for Economic Cooperation and Development (OECD), global consumption of cheese, butter and milk powder increased 13% from 2000 to 2005. That's more than triple the growth rate of the previous five years.

It should come as no surprise that consumption in the non-OECD developing countries jumped 21% in the first half of the decade, vs. growth of 8% in the OECD countries.

Further, per-capita fluid milk consumption is higher in much of the developing world. For instance, consumption in China has doubled in the last three years to 3 gals. per person, per year.

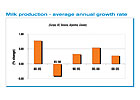

Global milk production, meanwhile, has been unable to keep pace.

Output in the world's major dairy exporting supply regions-the EU-25 (plus Switzerland and Norway), United States, Oceania, Argentina and Canada-increased a paltry 2% from 2000-2005, according to OECD. That's an incremental gain of just 2.6 billion lbs. of milk per year-no more milk than is produced in Vermont.

In this new world order-surging demand and tight supply-the United States has ramped up exports over the last two years to fill the gap. From July 2004 to June 2006, the aggregate export volume of U.S. SMP, cheese, whey proteins and lactose was more than 150 million lbs. per month, 60% greater than the monthly pace in the prior two-year stretch, according to USDA trade data. SMP exports more than doubled, as hungry and thirsty buyers sought out American powder and made the United States the world's leading supplier.

In 2005, U.S. dairy exports reached a record-high $1.67 billion.

Global consumption of cheese, butter and milk powder, by aggregate product volume, increased 13% from 2000 to 2005, more than triple the growth rate of the previous five years. Consumption is projected to rise another 8% by 2010.

Positive outlook

Look for more of the same for the foreseeable future, experts say.Global demand is poised to continue on a fast growth track. Aggregate consumption of cheese, butter and milk powder is forecast to rise another 8% from 2005 to 2010, led by 13% growth in the non-OECD countries. Milk consumption in China is expected to rise another 37%.

Meanwhile, our competitors in Europe, Oceania, Argentina and Canada are forecasted to ramp up milk output by about 8% during the period, keeping supply and demand finely balanced.

Output in the world's major dairy exporting supply regions-the EU25 (plus Switzerland and Norway), United States, Oceania, Argentina and Canada-increased just 0.4% annually from 2000 to 2005. OECD projects 4% annual milk production growth for New Zealand and Argentina for the balance of the decade, which still will not meet the growing demands of the world's consumers.

Which leaves the United States.

"Supply conditions worldwide point to the United States as one of the most viable regions for increasing production and exports," says Rabobank's Reca. "There are structural changes within the U.S. dairy sector leading to lower production and processing costs that will result in the United States playing a larger role in world dairy trade going forward."

U.S. growth potential is determined by the competitiveness of the entire value chain, from milk production, collection, processing and distribution, Reca explains. Throughout that chain, the United States is among the most competitive in the world. However, Reca offers a caveat that could mar his outlook.

"North American companies show varying degrees of ambition toward the global market," he says. "The United States has the growth potential, but it is lacking an export tradition.

"For too long, the U.S. export strategy was basically disposing of excess product. There needs to be an export strategy within each company, not just for their excess but for their regular supply," Reca continues.

If the U.S. industry can overcome its domestic mindset, the most lucrative opportunities are in foodservice cheese and value-added ingredients, Reca believes.

"U.S. companies do very well dealing with the foodservice market, but they've been shy when it comes to overseas markets. For instance, as pizza chains expand into developing countries, particularly in Asia, mozzarella can be supplied by the United States. These multinational chains are looking for quality and they won't be satisfied limiting themselves to local supply," he says.

Of course, the United States has been a leading supplier of whey proteins and lactose to most major markets for a number of years. With distribution and market-share established, the next task is to develop and deliver value-added, higher-protein whey products, for both the food and feed sectors, Reca suggests.

In fact, expanding overseas markets for whey proteins and lactose in the years ahead will be a necessity to enable the U.S. dairy industry to thrive.

Over the last decade, U.S. milk production has increased 18%, and co-ops and manufacturers have almost exclusively built cheese plants to handle the extra milk. The more cheese we make, the more whey and lactose is generated. Last year we exported 40% of our sweet whey and whey protein concentrate, 55% of our whey protein isolate and 61% of our lactose. In the future, those ratios will undoubtedly be higher.

"If we don't, it will have a negative effect on the profitability of all cheese companies," Reca says.

On an aggregate-volume basis, U.S. exports of selected dairy products have increased 45% in the last two years.

Going forward

We recognize that global dairy markets, like domestic markets, are cyclical. But in general, international prices are expected to trend higher in the years ahead, closing the gap that once existed between the United States and the world.Significantly, U.S. exports reached record-high levels during a high-price, tight-supply cycle in the domestic market.

"We've also discovered we can no longer look at exports in a vacuum, something separate or extra from our day-to-day business," USDEC's Suber continues. "Exports are part of the structure of the U.S. dairy industry now. We exported more than 8% of our production last year, and that percentage is growing every year. What happens in the international market has a direct impact on our domestic market, and vice versa."